3 minutes

ECOM6013 E-Commerce Payment Systems

Overview

Security, trust, and e-commerce

- e-commerce (by definition) means transfer of value which can be

- resources

- information

- payments

- entertainment

- all of these types of value are desirable and therefore subject to theft

- perhaps, none more than payments (which drives commerce)

- it is all about money

Payment system stakeholders' priorities

- consumers

- low-risk, low-cost, refutable, convenience, reliability

- merchants

- low-risk, low-cost, irrefutable, secure, reliable

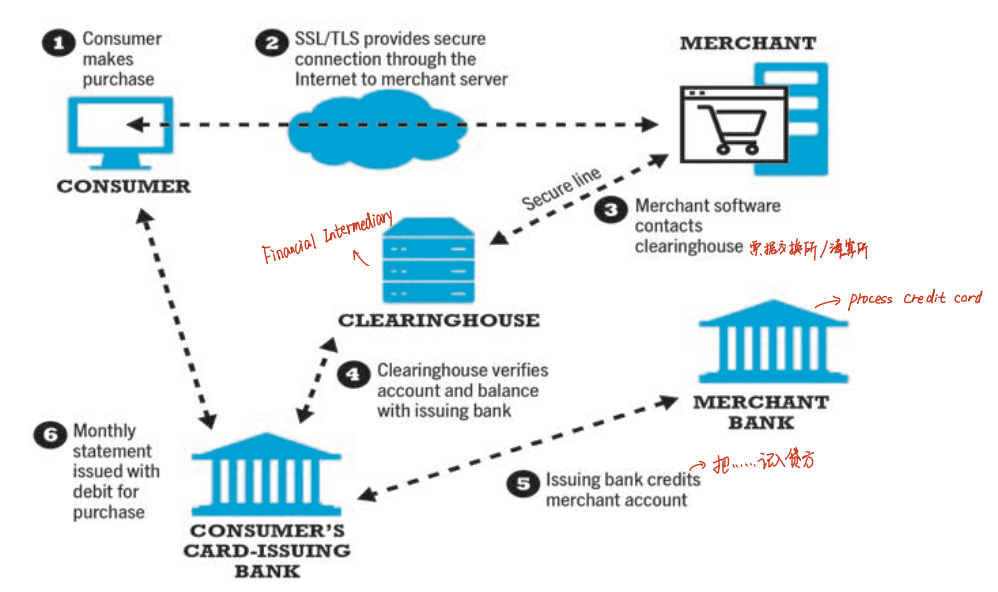

- financial intermediaries

- secure, low-risk, maximizing profit

- government regulators

- security, trust, protecting participants and enforcing reporting

Types of payment system

- cash

- most common form of payment in terms of number of transactions (changing quickly)

- instantly convertible into other forms of value without intermediation

- cheque transfer

- second most common payment form in the United States in terms of number of transactions; costly and slowly diminishing in most part of the world

- credit card

- credit card associations

- issuing banks

- processing centers

- stored value

- funds deposited into account, from which funds are paid out or withdrawn as needed, e.g., debit cards, gift certificates, Octopus

- peer-to-peer payment systems (e.g. payme.com)

- accumulating balance

- accounts that accumulate expenditures and to which consumers make periodic payments

- e.g., utility, phone, standing accounts of trusted businesses

- often either with a large deposit, or prepaid

Payment Systems

B2C payment systems

- credit cards

- financial cybermediaries

- on internet-based company that makes it easy for one person to pay another person or organization over the internet

- e.g., Alipay, PayPal, WeChat Pay, Octopus, Obopay

- electronic checks

- electronic bill presentment and payment

- smart cards

- mobile payment

E-commerce payment systems

- credit cards

- limitations of online credit card payment

- security, merchant risk

- cost

- social equity

- limitations of online credit card payment

- debit cards

- digital wallets

- emulates functionality of wallet by authenticating consumer, storing and transferring value, and securing payment process from consumer to merchant

- early efforts to popularize failed

- digital cash

- value storage and exchange using tokens

- most early examples have disappeared

- protocols and practices too complex

- digital checking

- extends functionality of existing checking accounts for use online

- online stored value systems

- based on value stored in a consumer’s bank, checking, or credit card account

- PayPal, Alipay, WeChat Pay

- smart cards

- plastic card (the size of a credit card) that contains an embedded chip on which digital information can be stored and updated

- debit cards are an implementation

- contact -> use card reader

- contactless

- e.g., EZPass, Octopus card (Hong Kong)

- Radio Frequency ID (RFID)

- Near Field Communications (NFC)

- plastic card (the size of a credit card) that contains an embedded chip on which digital information can be stored and updated

B2B payment systems

- for business customers

- make large purchases

- will not pay with credit card or financial cybermediary

- use financial Electronic Data Interchange (EDI) (but on its way out)

- pay for many purchases at once (perhaps the end of the month)

- likely that cloud-based payment gateway (or other Internet-based technology) will eventually take over completely

- Faster Payment System (FPS) (if local in Hong Kong)

The future

- they are attempts to export existing payment systems that work in traditional commerce to e-commerce

- sometimes problems with existing payment systems are magnified when moved to the online world (e.g. credit card theft)

- what is needed is a payment/financial system designed for the online world

- these are defined as cybercurrencies or digital currency