4 minutes

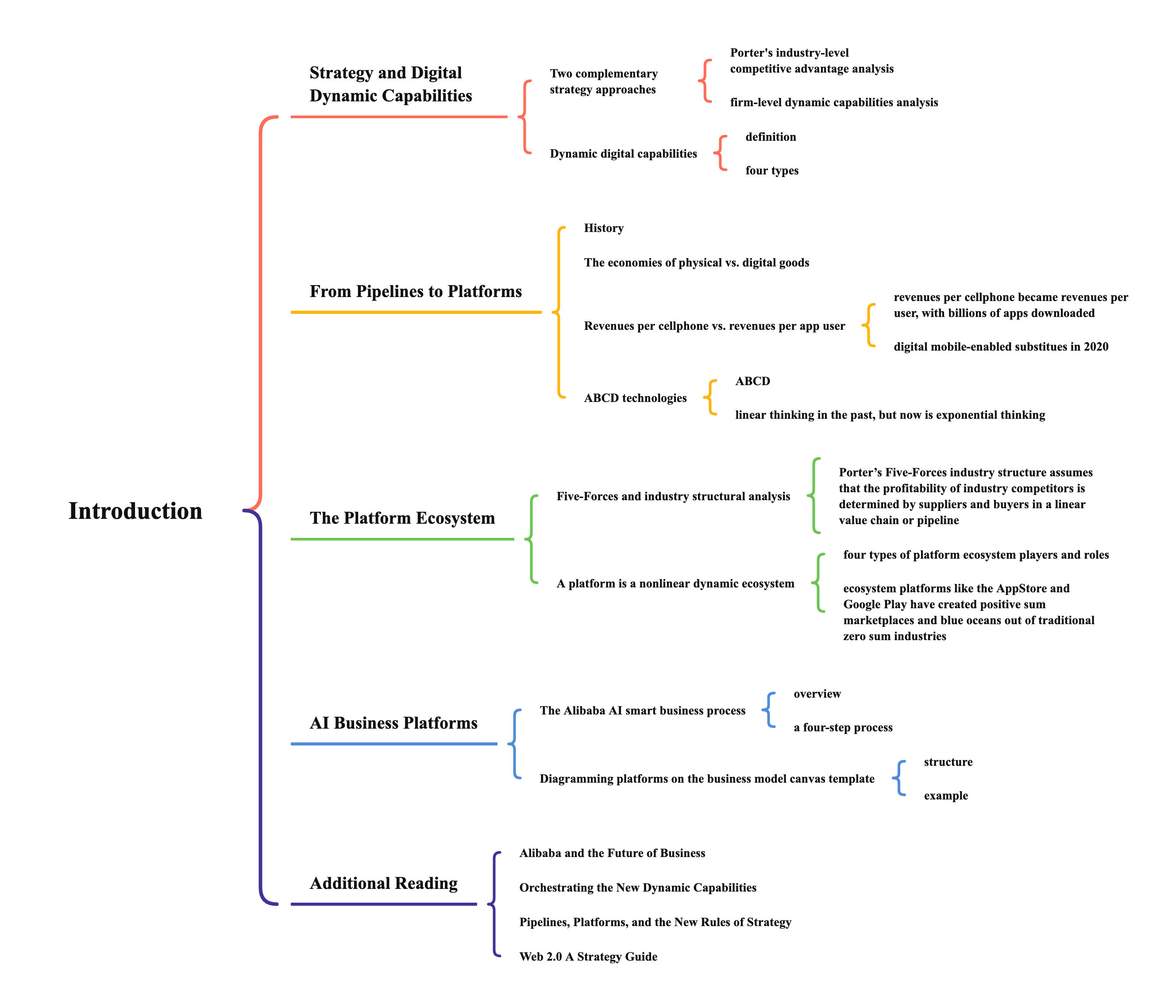

ECOM7121 Introduction

Strategy and Digital Dynamic Capabilities

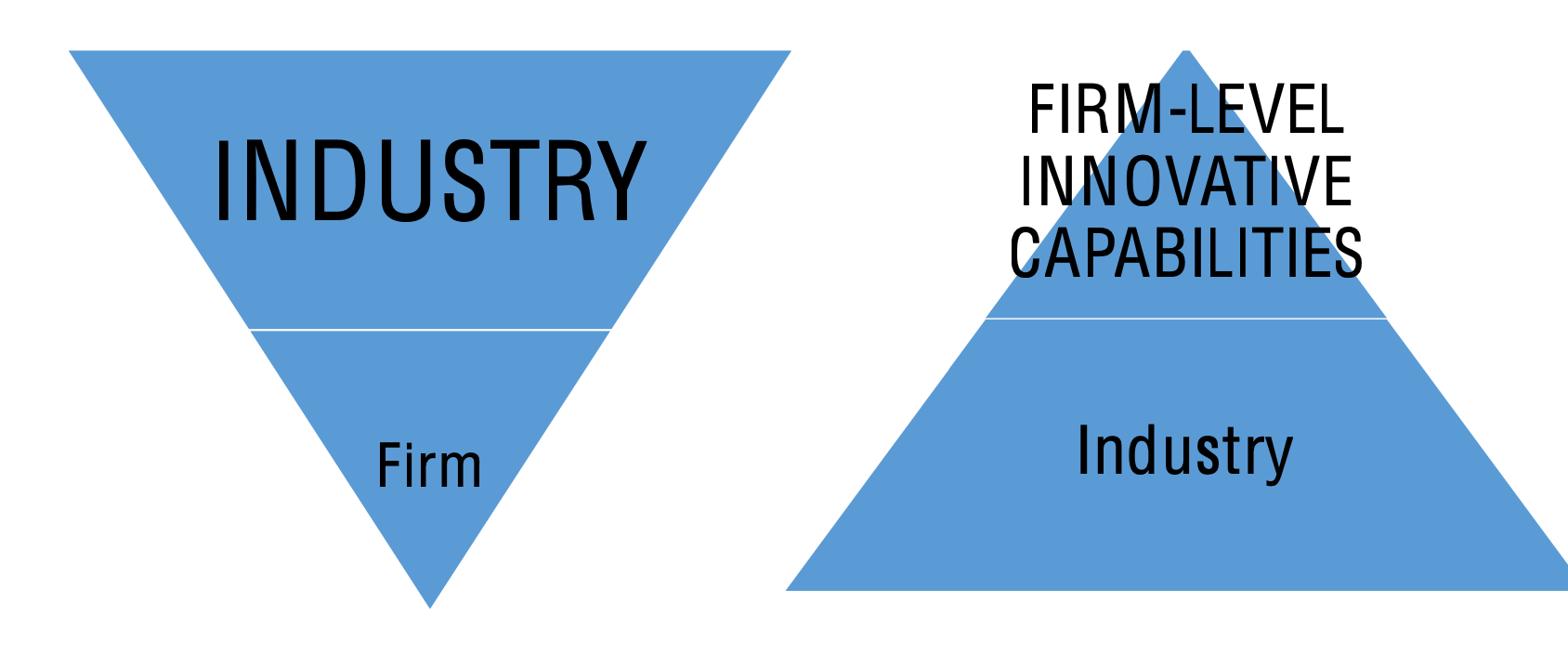

Two complementary strategy approaches

- Porter’s industry-level competitive advantage analysis

- industry contains lots of firms

- firms would compete with each other

- a firm want to be better, it should do better than the industry average

- example: mobile industry pre-2007

- strategic recommendations to companies below the average

- raise price through differentiation

- can do something in design, e.g. Samsung and Armani

- lower cost to improve profitability

- it was not very easy to do because what you could do for cost was already being driven down as much as possible globally

- raise price through differentiation

- strategic recommendations to companies below the average

- firm-level dynamic capabilities analysis

- start by the firm

- firms can actually disrupt, shape and transform entire industries

- example: Apple transformed mobile industry in 2008

- by digital innovation (AppStore)

- combining and collaborating

- have a company like Apple who can orchestrate that collaboration on a platform

- apple provide a platform (inside) for developers (outside)

- by digital innovation (AppStore)

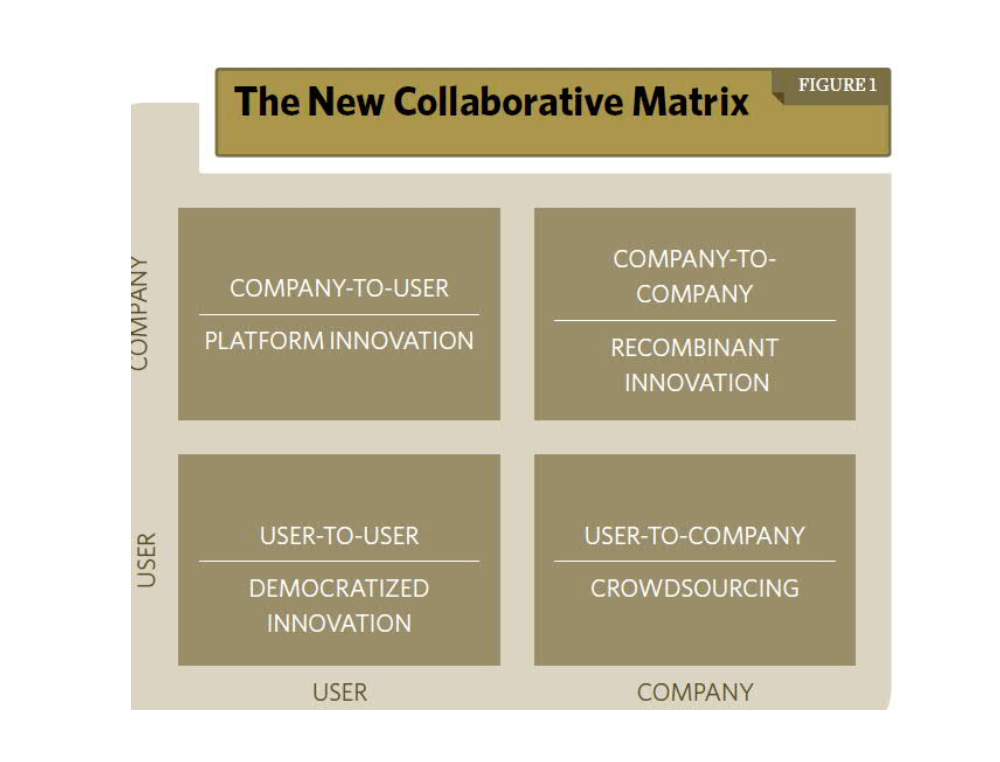

Dynamic digital capabilities

- definition

- firm-level strategic ability to combine inside and outside digital competences to address volatile environments and periods of rapid change

- four types

- democratized innovation

- user-to-user or peer-to-peer collaboration produces positive network effects with public good benefits

- founders no value

- e.g. Wikipedia

- crowdsourcing

- user-to-company collaboration produces positive network effects, often through 2-sided markets so that free users are subsidized by paying customers

- typically, a company is able to capture tangible, monetary benefits from the community in exchange for continued innovation and improvement

- users can get profit

- e.g. voting for your perference

- platform innovation

- company-to-user innovation where a company provides the platform for users and developers to distribute their software, applications or digital goods to their social or professional networks or to the marketplace at large.

- e.g. Apple, because it provided a platform

- recombinant innovation

- company to company

- e.g. Apple and Gracenote

- democratized innovation

From Pipelines to Platforms

History

- cellphones transformed to smartphones

- in 2008, the “dumb cellphone” became a smartphone with a networked platform of downloadable and shareable software apps

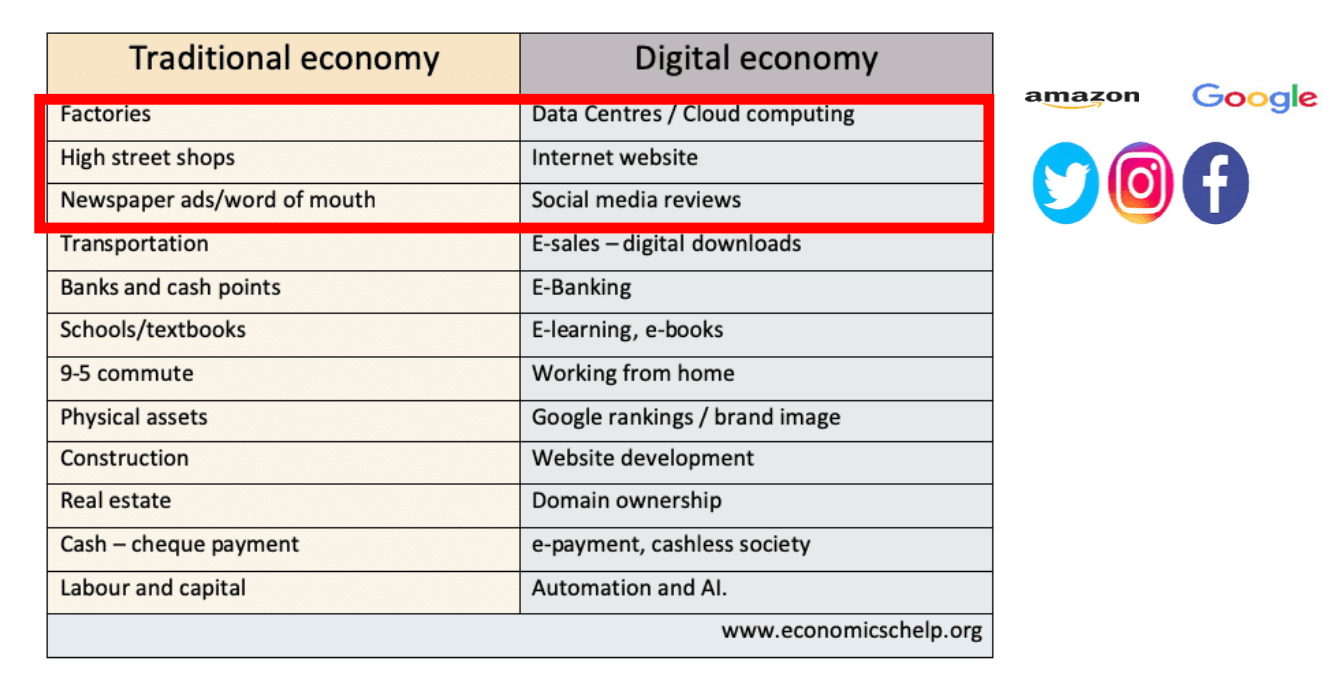

The economies of physical vs. digital goods

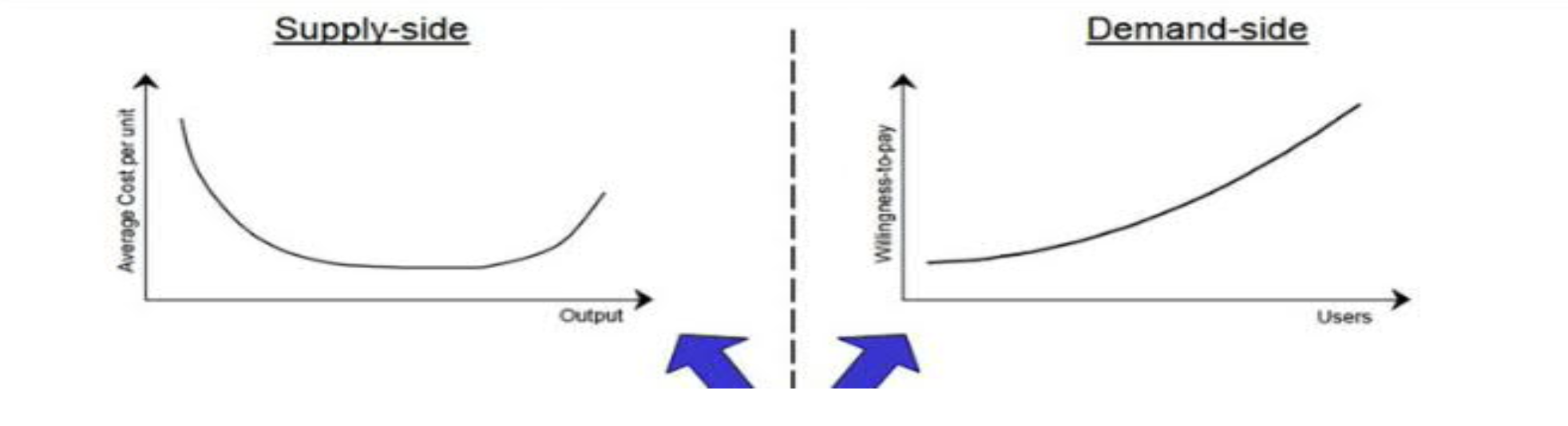

- the shift from physical to digital goods triggered a shift from demand-side economies to supply-side economies

- supply-side scale

- if the company makes a lot of cellphones, the cost would be lower

- e.g. Nokia

- demand-side scale (or network effects)

- the value to users actually increases with the network, rather than with manufacturing costs

- e.g. Apple

- supply-side scale

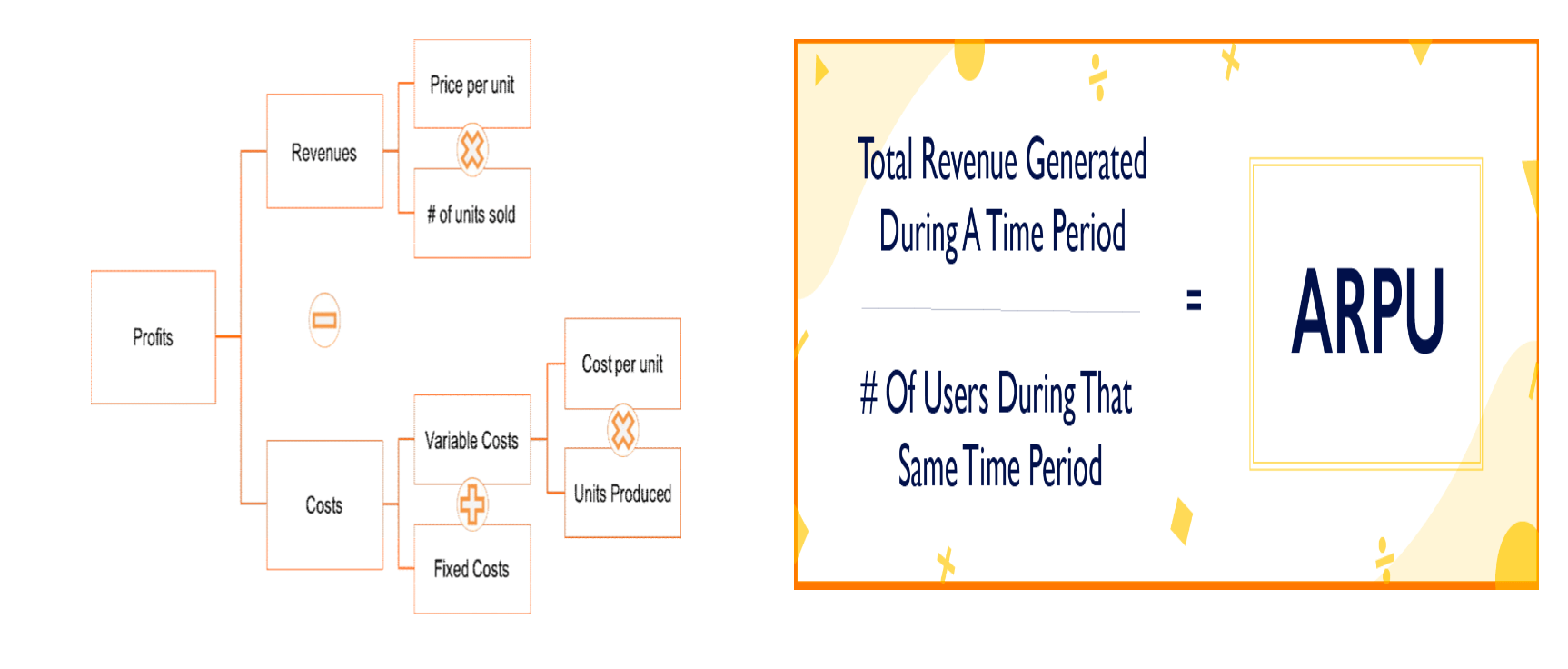

Revenues per cellphone vs. revenues per app user

- revenues per cellphone became revenues per user, with billions of apps downloaded

- examples

- Nokia: per cell phone

- Apple: both iPhone and revenues generated from users (may not much money from per user, but the number of users is large)

- ARPU: average revenue per user

- take 30% fee from developers

- examples

- digital mobile-enabled substitues in 2020

- digital companies are more profitable because they are able to use demand-side economies, rather than supply-side economies

- digital companies are more profitable because they are able to use demand-side economies, rather than supply-side economies

ABCD technologies

- ABCD

- AI

- blockchain

- cloud

- data

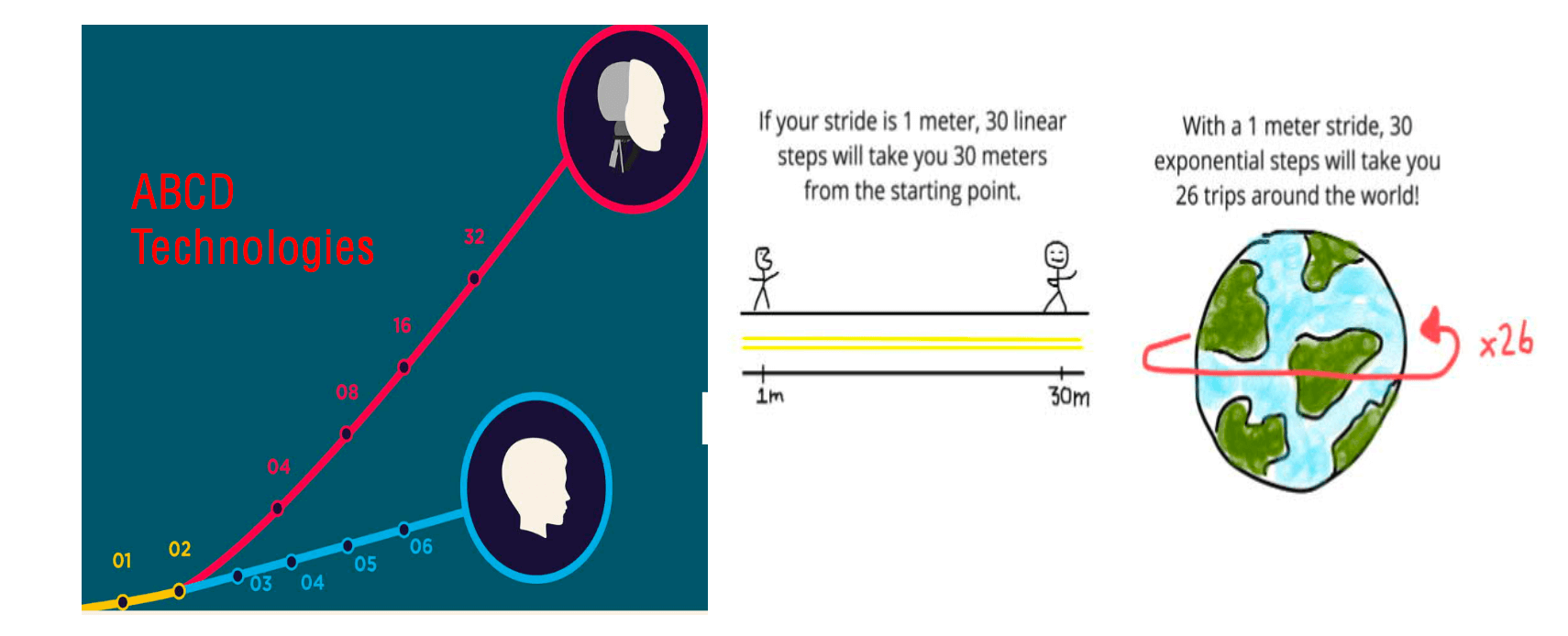

- linear thinking in the past, but now is exponential thinking

- exponential growth in digital goods = zero transaction costs + networks + crowds

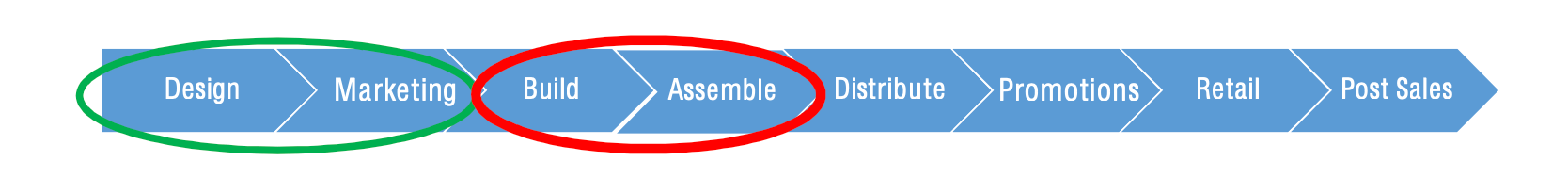

- “dumb cellphone” value chain in 2007 was linear (as the first picture of this page)

The Platform Ecosystem

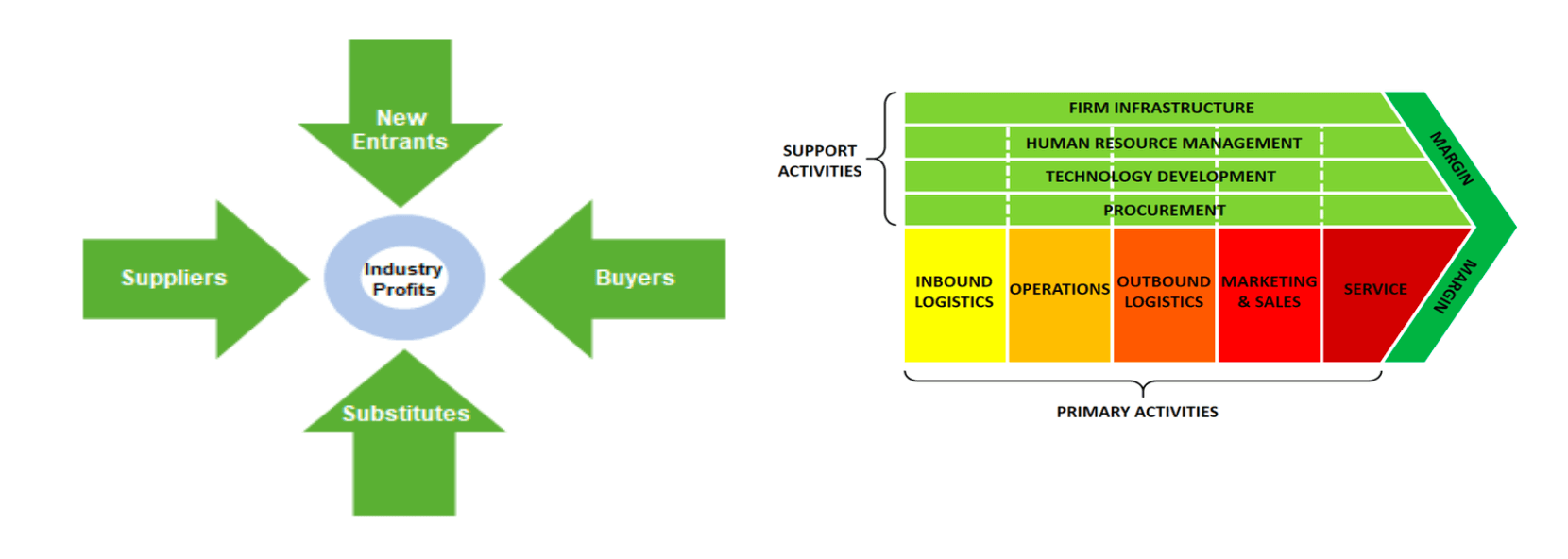

Five-Forces and industry structual analysis

- Porter’s Five-Forces industry structure assumes that the profitability of industry competitors is determined by suppliers and buyers in a linear

value chain or pipeline.

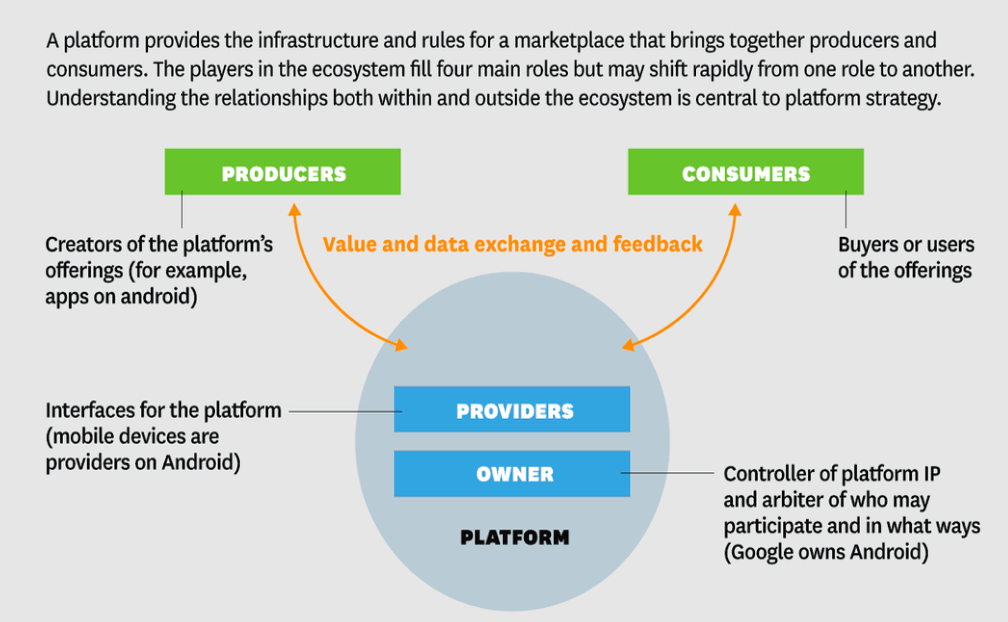

A platform is a nonlinear dynamic ecosystem

- four types of platform ecosystem players and roles

- owners of the platform that control IP and governance

- providers that serve as the platform interface with users

- producers that create offerings on the platform

- consumers that use those offerings

- example: Apple Appstore’s platform ecosystem

- Apple = owners of the AppStore iOS platform that control IP and governance

- Apple iPhone and iPad = providers that serve as the iOS platform interface with users

- Apple iPhone iOS App Developer = producers that create offerings on the platform

- consumers that use those offerings

- Apple’s AppStore is a non-linear, dynamic and interactive ecosystem

- Apple orchestrates and facilitates the network and users and developers and receives 30% of the app developers' revenues for managing the AppStore

- ecosystem platforms like the AppStore and Google Play have created positive sum marketplaces and blue oceans out of traditional zero sum industries

- where value is created for users, developer, providers and platform owners

- three types of games

- positive sum: economic, financial or social rewards are created as a result of playing the game

- zero sum: the total rewards available from playing the game are independent of the procee of play

- negative sum: economic, financial or social rewards are destroyed as a result of playing the game

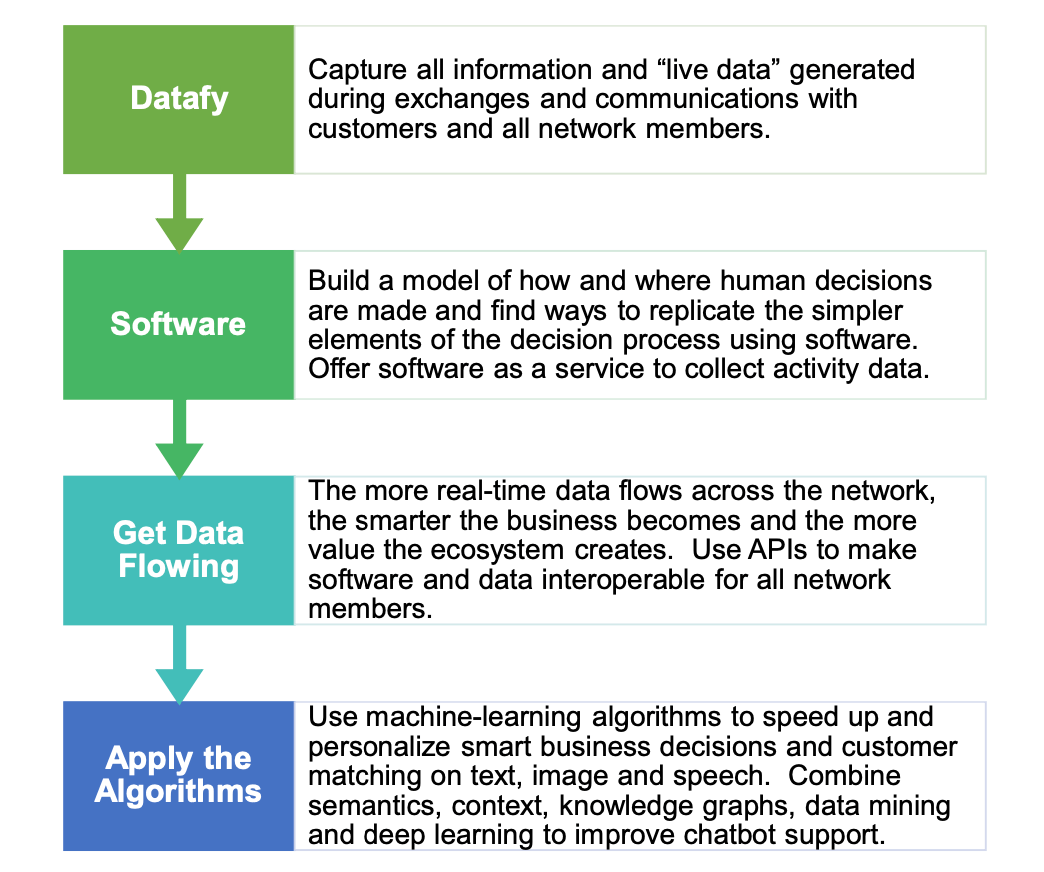

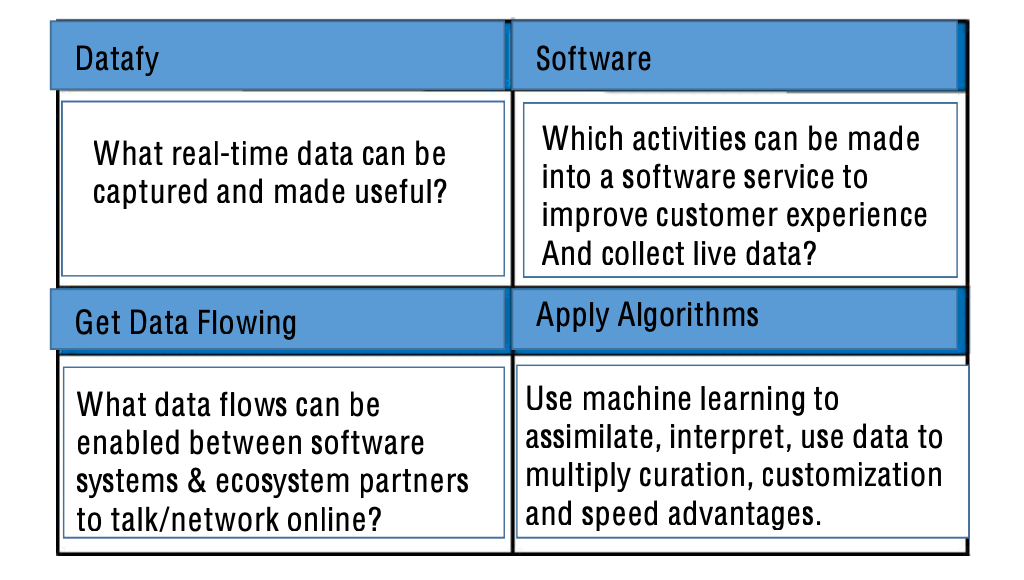

AI Business Platforms

The Alibaba AI smart business process

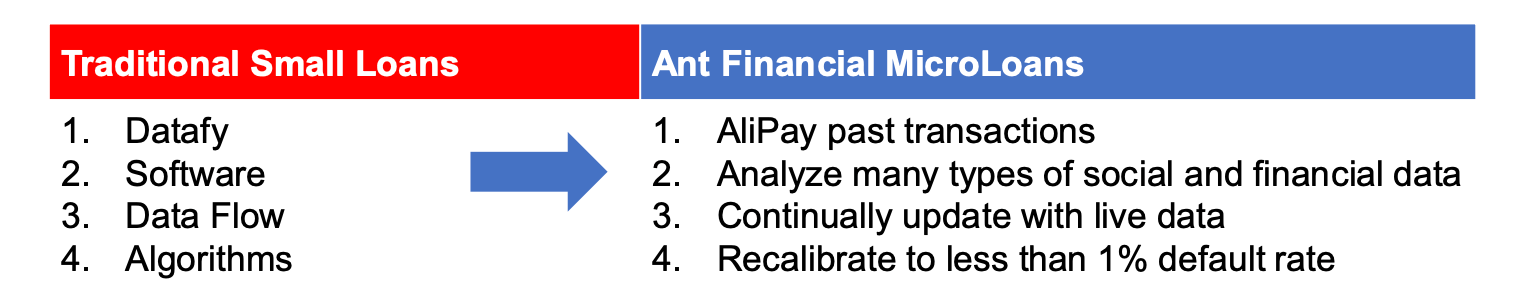

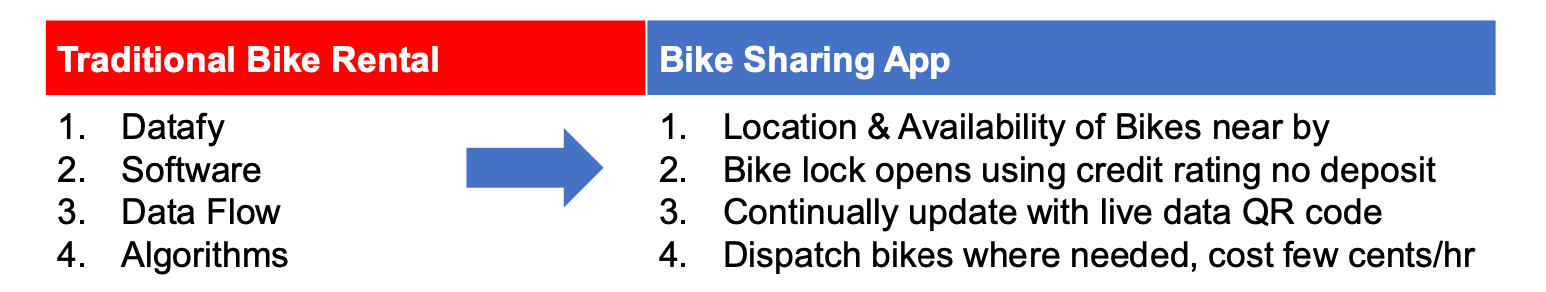

- overview

- a four-step process

- examples

- applying the AI smart business four-step process for Ant Financial Micro Loans

- applying the AI smart business four-step process for online bike sharing and sesame credit

- applying the AI smart business four-step process for Ant Financial Micro Loans

- examples

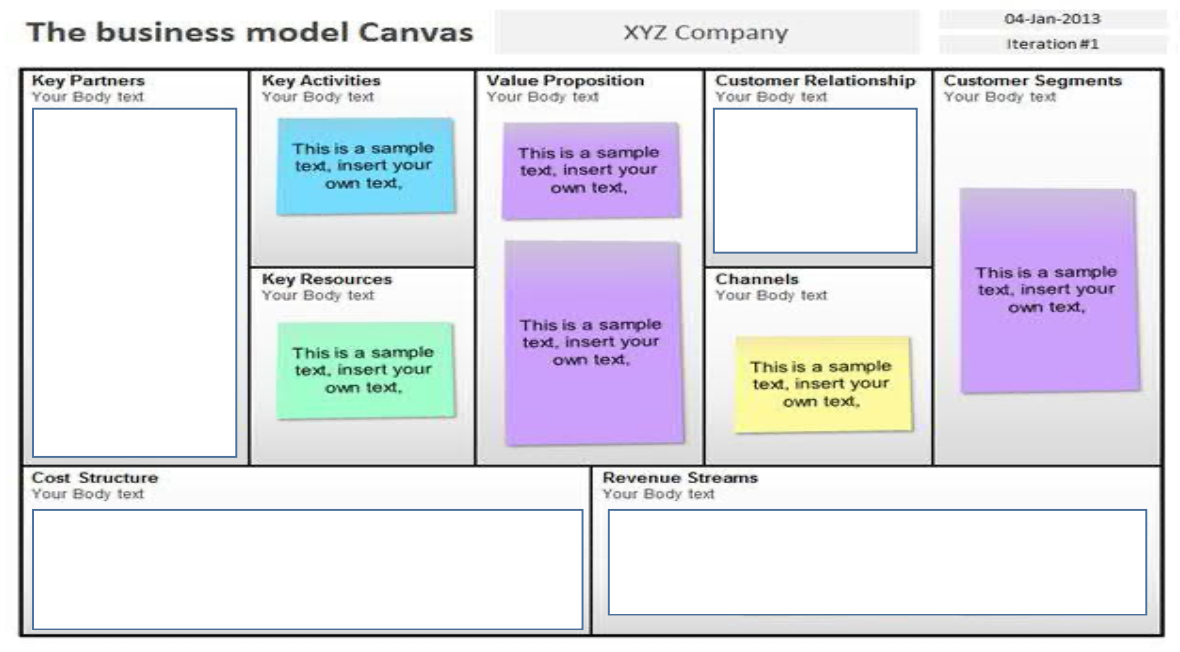

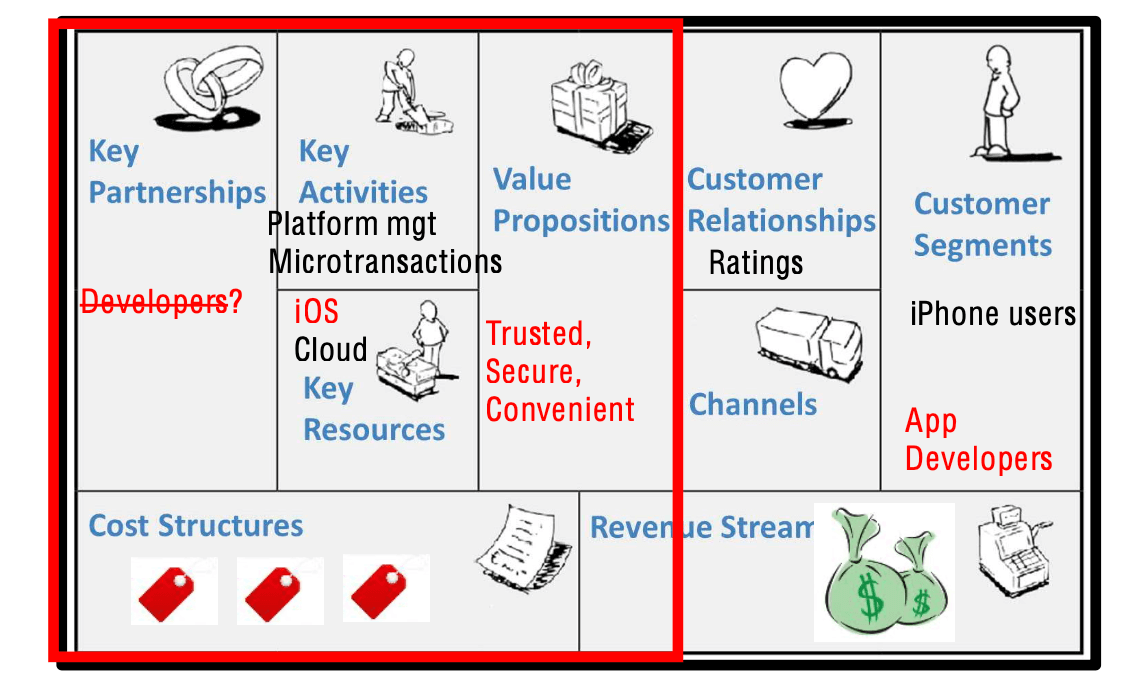

Diagramming platforms on the business model canvas template

- structure

- example: Apple iOS AppStore platform

Additional Reading

ecom7121 dynamic digital capabilities dynamic capabilities platforms and ecosystems introduction

824 Words

2020-10-27 17:37