3 minutes

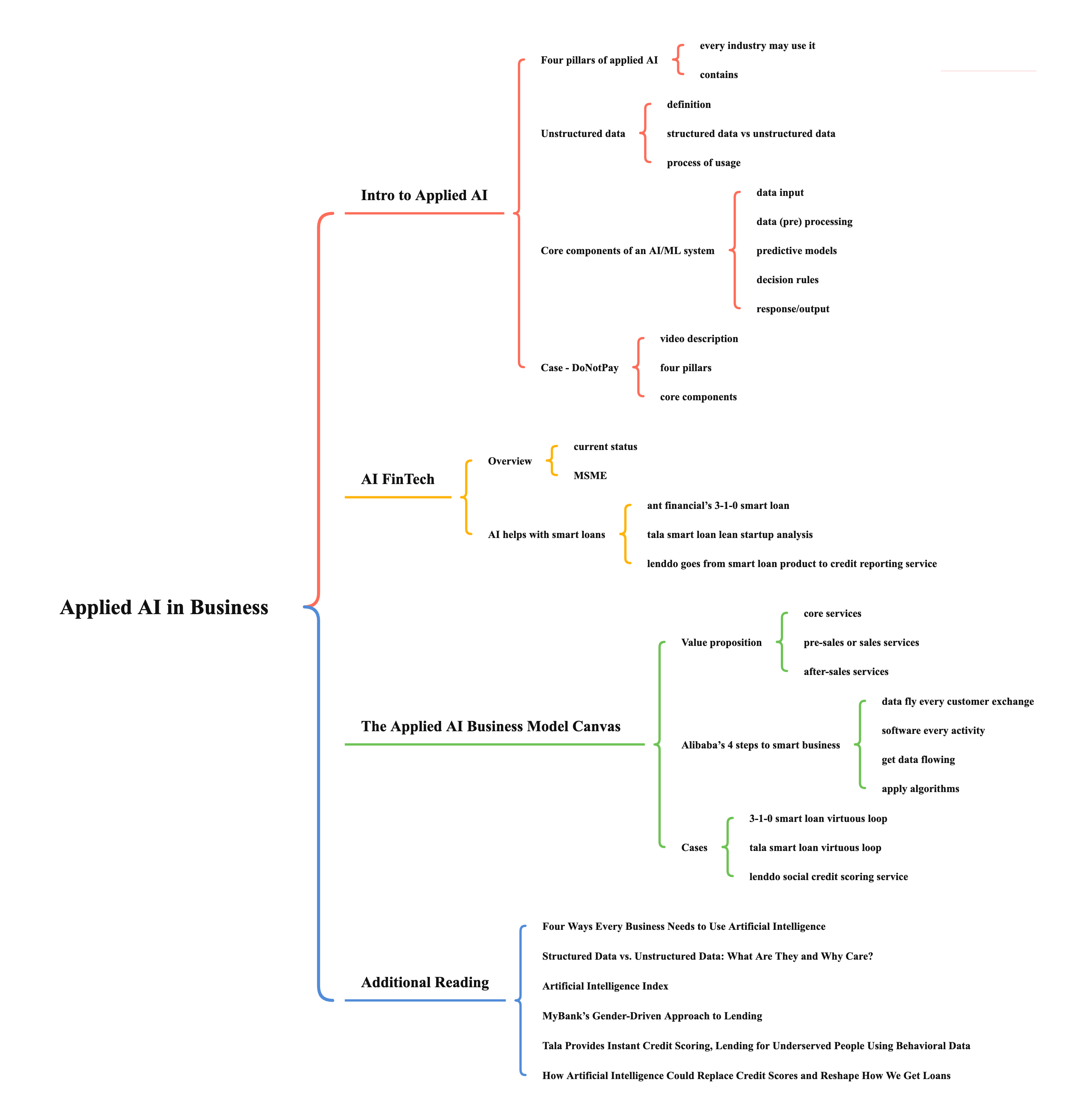

ECOM7122 Applied AI in Business

Intro to Applied AI

Four pillars of applied AI

- every industry may use it

- contains

- virtual assistance

- apple siri, etc.

- chat robot

- generating insights

- machine learning

- automation of manual processes

- industrial robot

- machine or program replacement for routine work

- unlocking unstructured data

- used structured data in the past, but can unlock unstructured data, transferring the books on the shelf into database

- understand consumer conversations, e.g. Mattersight uses call center conversations to identify customers’ personality types

- unstructured data

- virtual assistance

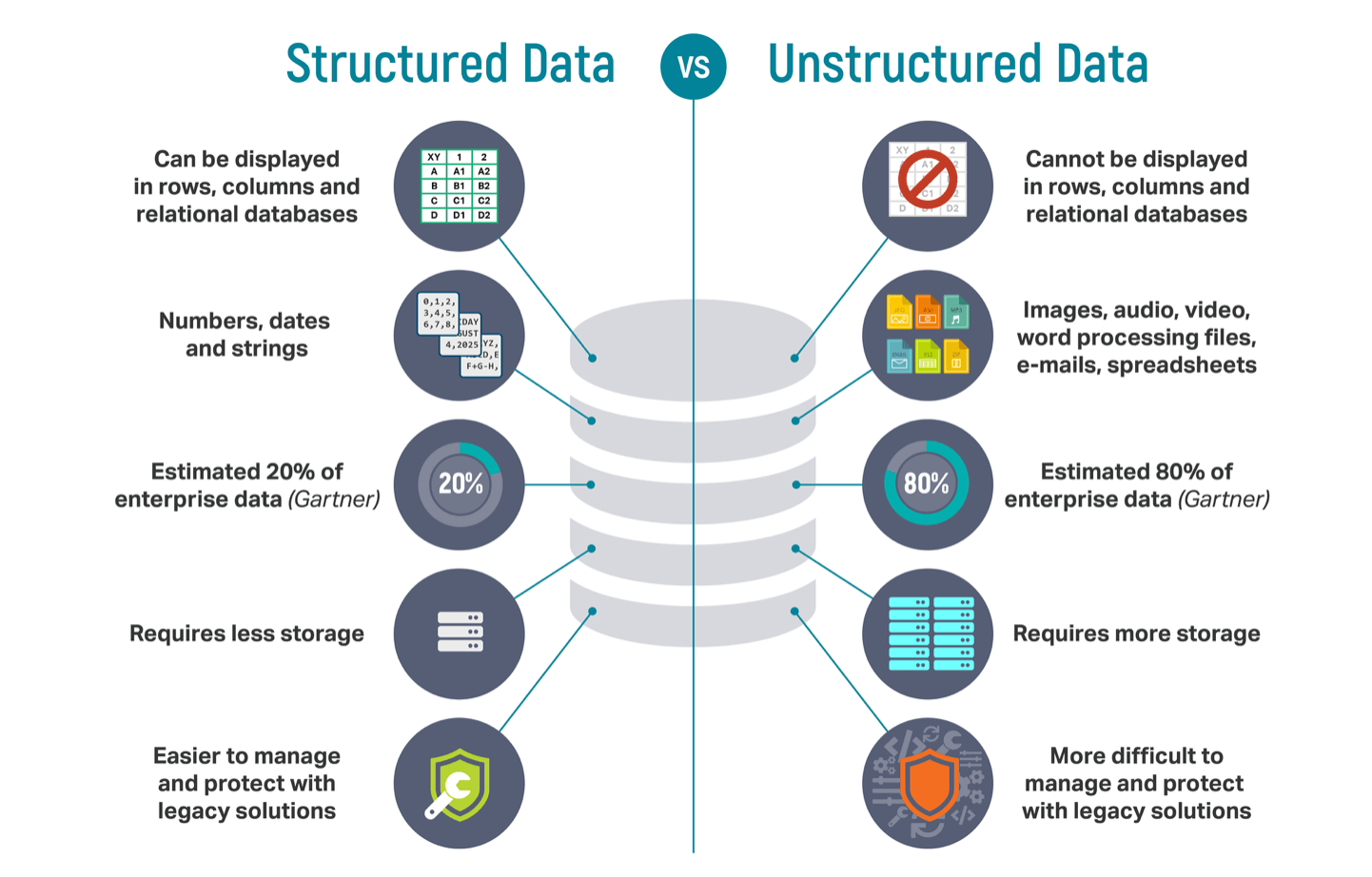

Unstructured data

-

definition

- cannot find the relationship between different values

- e.g. email, text files, social media, call center transcripts

-

structured data vs unstructured data

-

process of usage

- the breakthrough of image recognition and natural language voice recognition make the unstructured data unlocked

Core components of an AI/ML system

- data input

- data (pre) processing

- predictive models

- decision rules

- response/output

Case - DoNotPay

-

video description

- source of inspiration

- how to use

-

four pillars

- virtual assistance — mobile chatbot

- generating insights — likelihood of parking fee being dismissed

- automation of manual processes — Josh gives his advice & experience via a chatbot that generates a legal letter

- unlocking unstructured data — Josh found his successful legal protest strategy by reading up on many county parking laws and successful legal briefs

-

core components

- data input — text entered by user on mobile app

- data (pre) processing — rule-based chatbot

- predictive models — algorithms based on Josh’ experience

- decision rules — if [answers to question 1, 2 or 3 are yes], then [inform user that they should print a pdf letter of protest]

- response/output — user can print a pdf letter of protest that uses correct legal terms and language for their situation and asks for the parking fine to be dismissed

AI FinTech

Overview

- current status

- globally 1.7 billion adults are unbanked & do not have access to a bank loan

- MSME

- micro, small and medium sized businesses/enterprises

- are key to creating the 600 million new jobs needed by 2030 to keep pace with the growth of the world’s working-age population

- without access to loans and with little or no savings, MSMEs are at-risk

- they cannot plan and pay for regular expenses like family schooling, water, electricity

- an unexpected illness, medical expense, death in family, natural disaster can ruin their micro-business or make them homeless

- they cannot break out of their cycle of poverty

- loan from non-bank entities have extremely high interest rates - 300%, e.g.

AI helps with smart loans

-

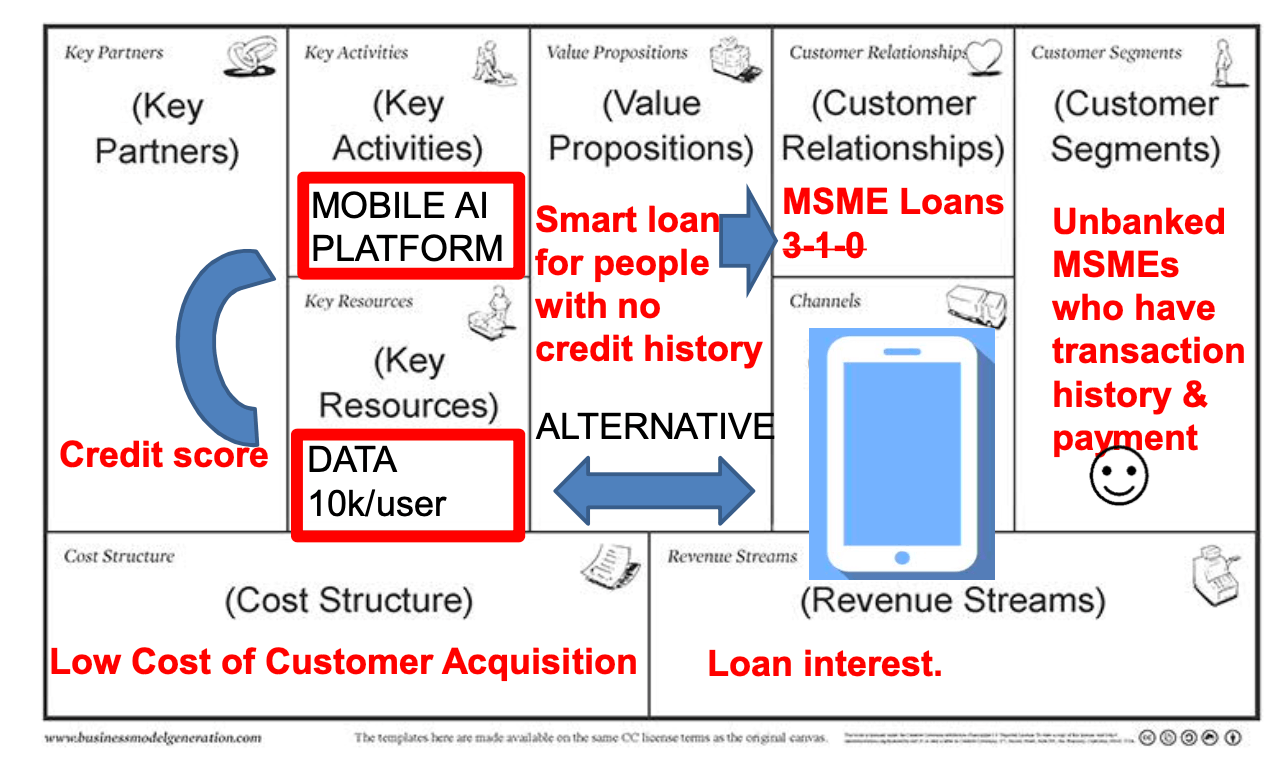

ant financial’s 3-1-0 smart loan

- 3 minutes to apply on mobile

- 1 second to approve

- 0 human intervention

- related video

-

tala smart loan lean startup analysis

- video description

-

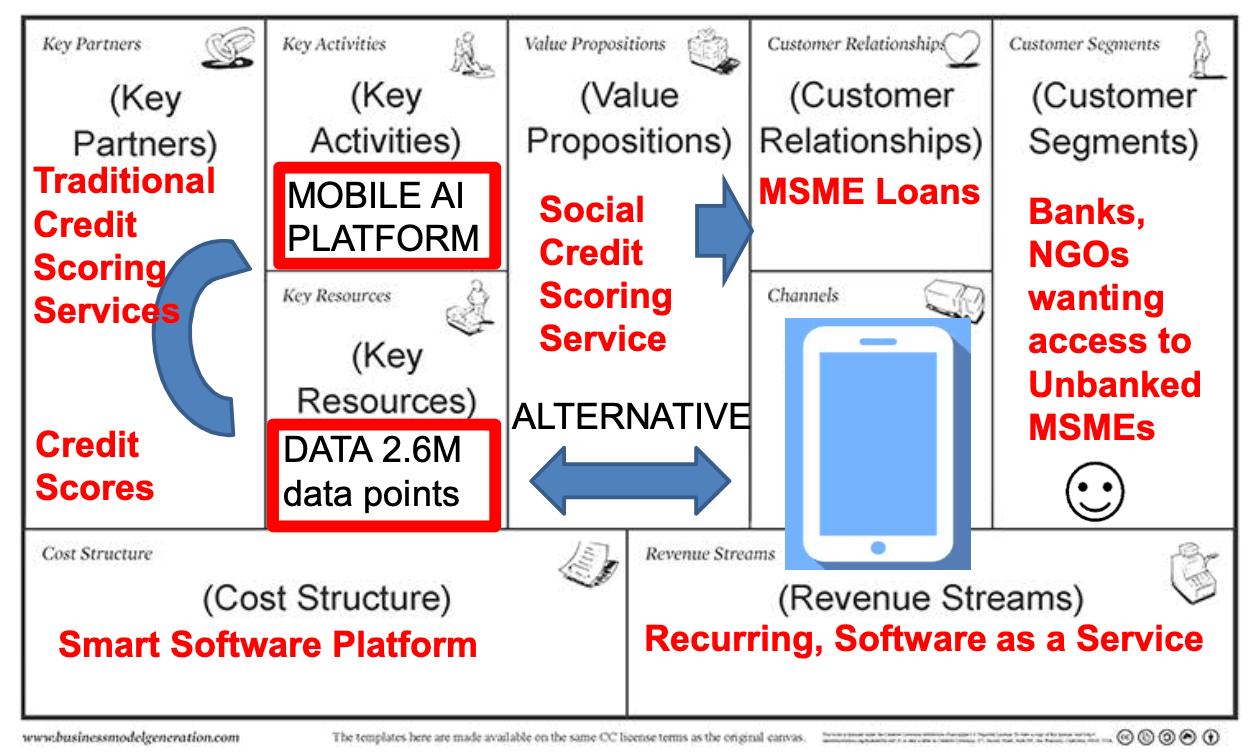

lenddo goes from smart loan product to credit reporting service

- video description

The Applied AI Business Model Canvas

Value proposition

- core services

- pre-sales or sales services

- after-sales services

Alibaba’s 4 steps to smart business

- datafy every customer exchange

- software every activity

- get data flowing

- apply algorithms

Cases

- 3-1-0 smart loan virtuous loop

- tala smart loan virtuous loop

- credit scores based on phone data

- stability in key relationships

- network diveristy

- location consistency

- financial transactions

- credit scores based on phone data

- lenddo social credit scoring service

Additional Reading

- Four Ways Every Business Needs to Use Artificial Intelligence

- Structured Data vs. Unstructured Data: What Are They and Why Care?

- Artificial Intelligence Index

- MyBank’s Gender-Driven Approach to Lending

- Tala Provides Instant Credit Scoring, Lending for Underserved People Using Behavioral Data

- How Artificial Intelligence Could Replace Credit Scores and Reshape How We Get Loans

ecom7122 entrepreneurship development and fintech ventures in asia entrepreneurship fintech ai

565 Words

2021-03-16 10:01