5 minutes

ECOM7122 Machine Learning, InsurTech and Ethical Considerations

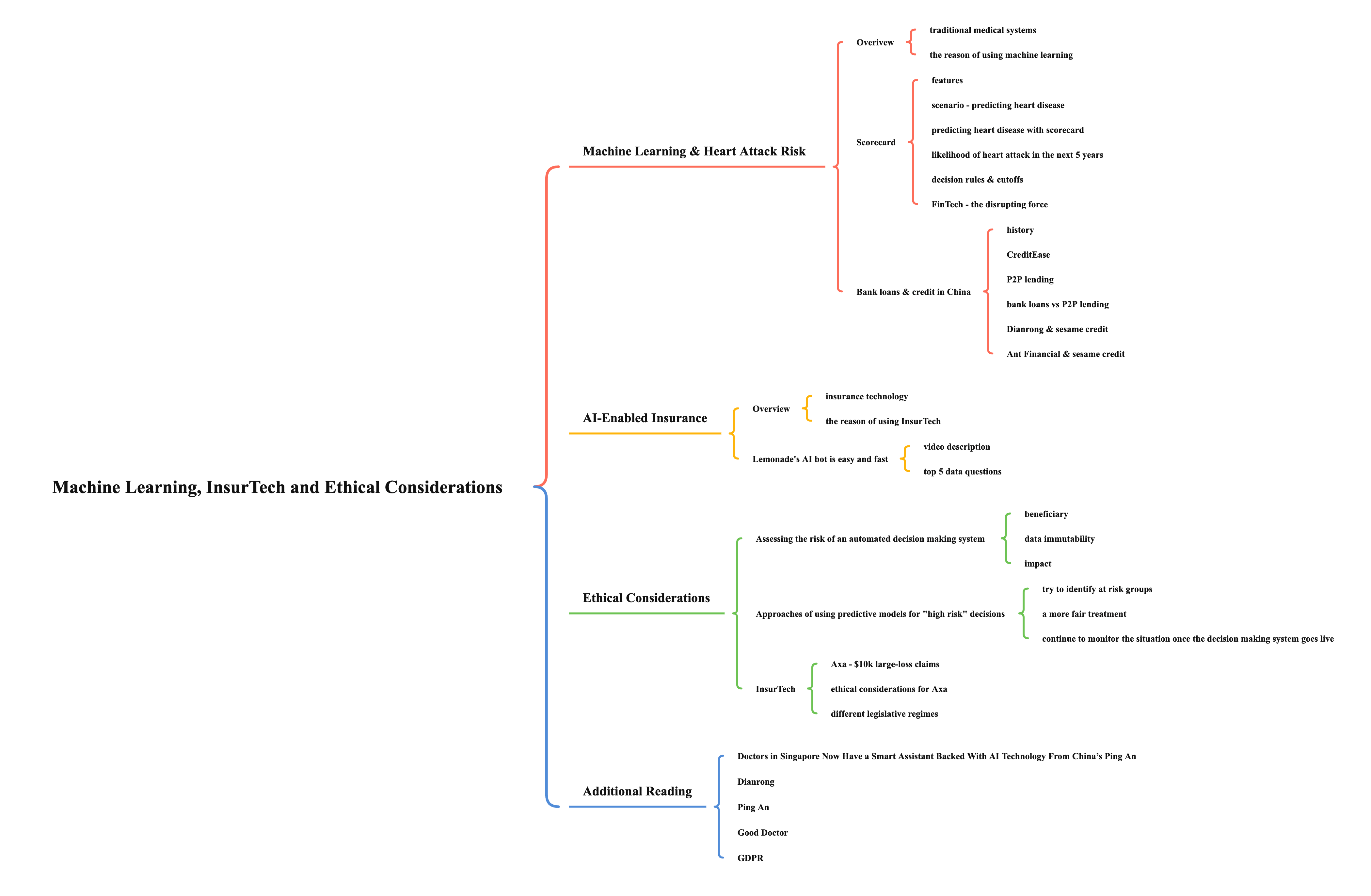

Machine Learning & Heart Attack Risk

Overview

- traditional medical systems

- treat illness when people are already sick

- the reason of using machine learning

- more accurate

- 20% - 30% better performance (means better prediction)

- “unbiased”

- statistical vs prejudicial bias

- fast

- automated decision making system

- but some decision making system may generate risks

- cheap

- predictive models work 24/7

- can provide medical services all the time

- more accurate

Scorecard

- features

- easy to understand and fits with our common sense and intuition

- it is “explainable” or “white-box”

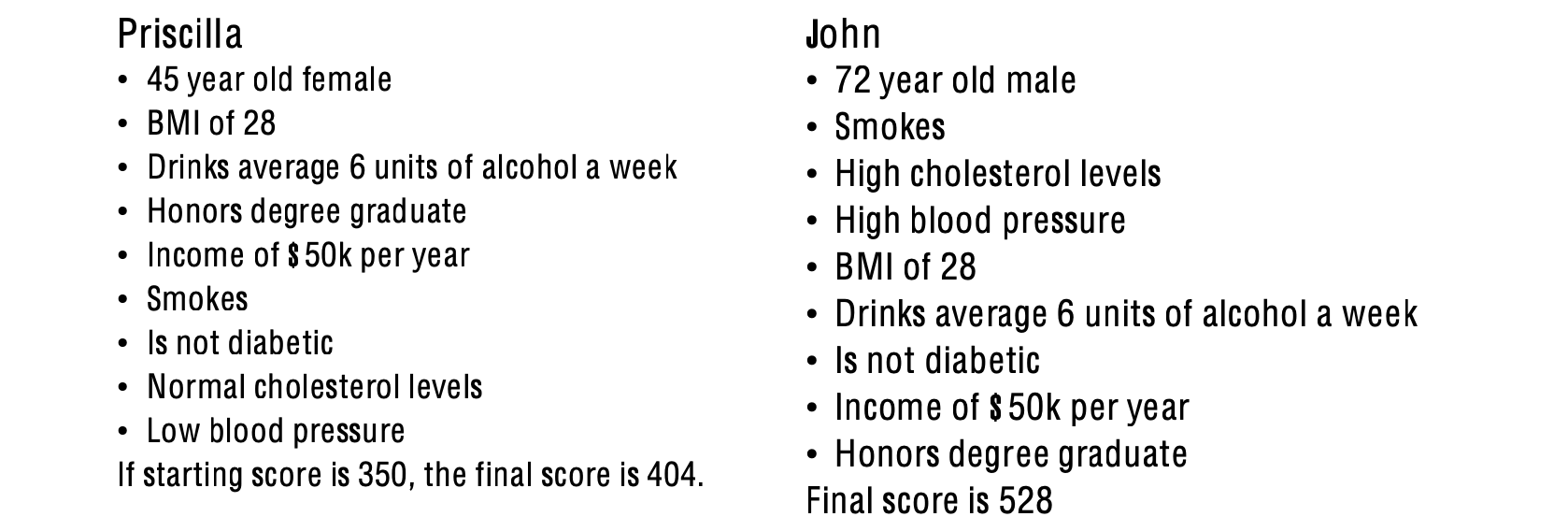

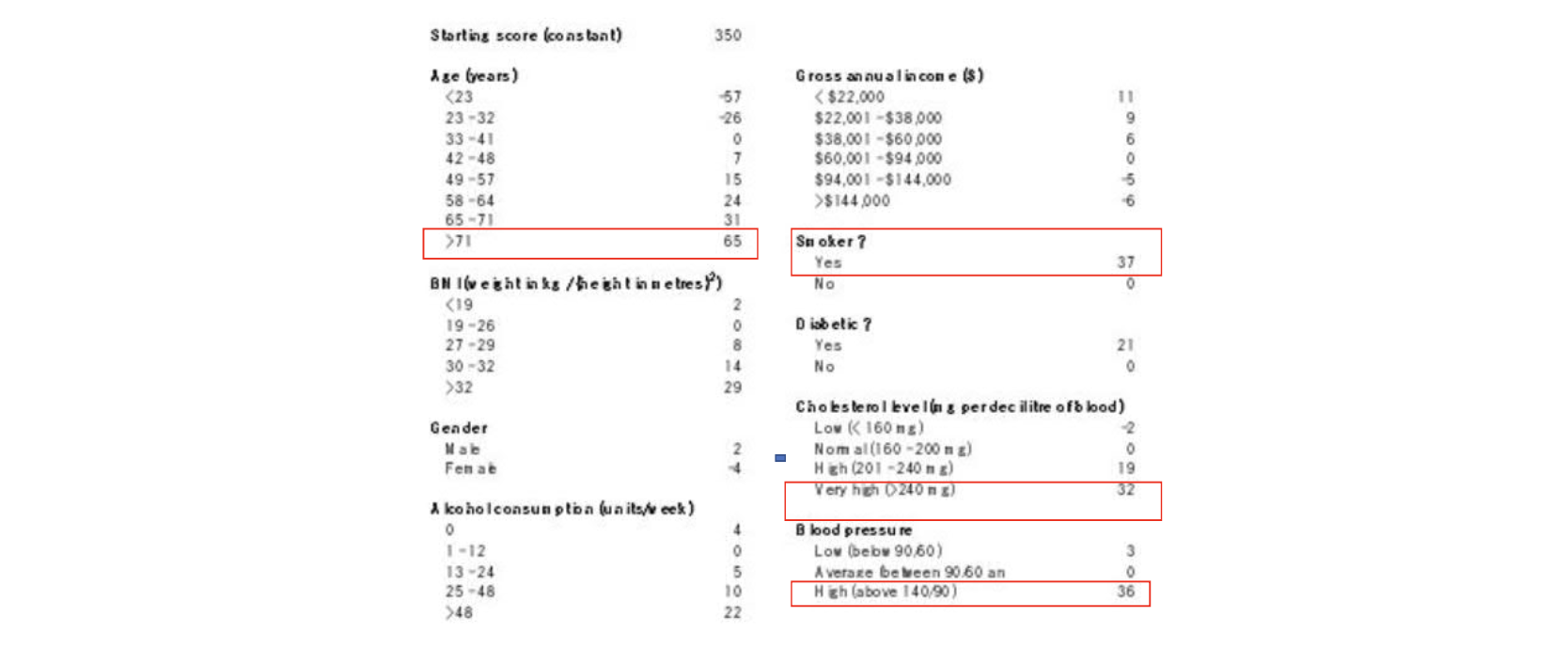

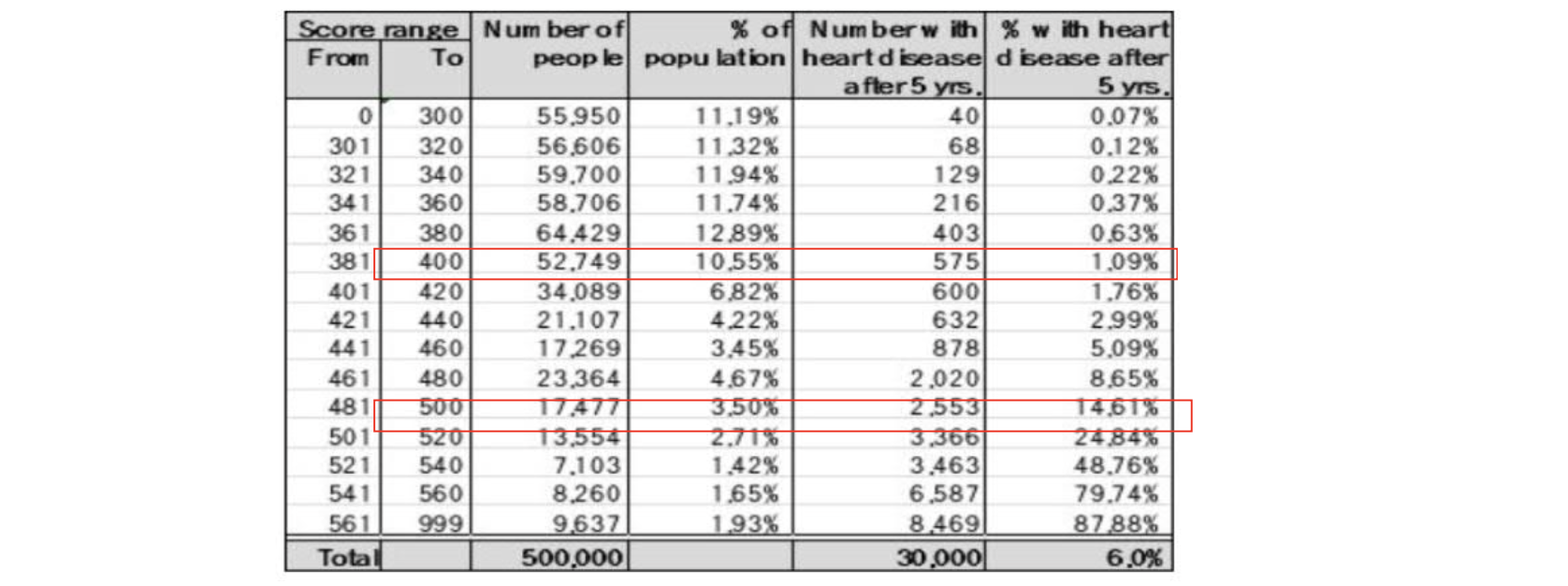

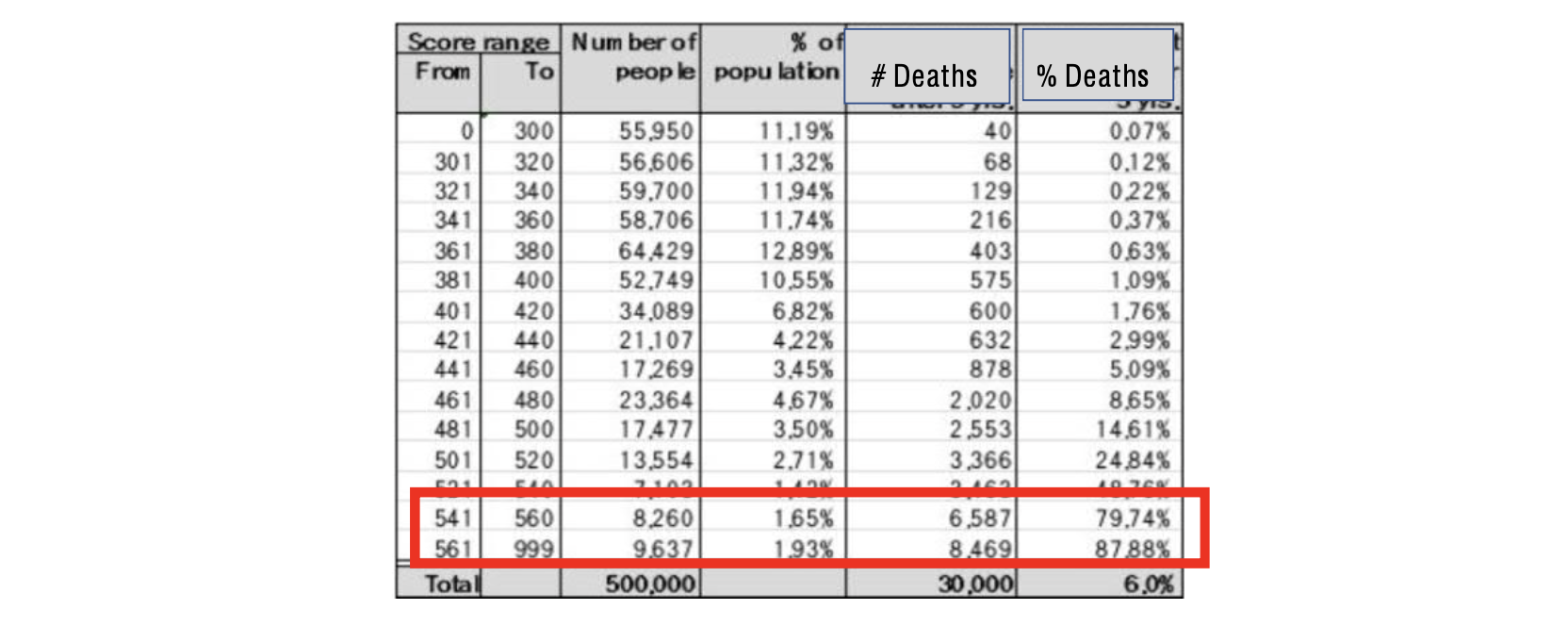

- scenario - predicting heart disease

- predicting heart disease with scorecard

- likelihood of heart attack in the next 5 years

- decision rules & cutoffs

- if this was a Covid-fatality risk calculator, who would you vaccinate first & why

- if this was a default risk calculator, who would you deny credit to, who would you loan to

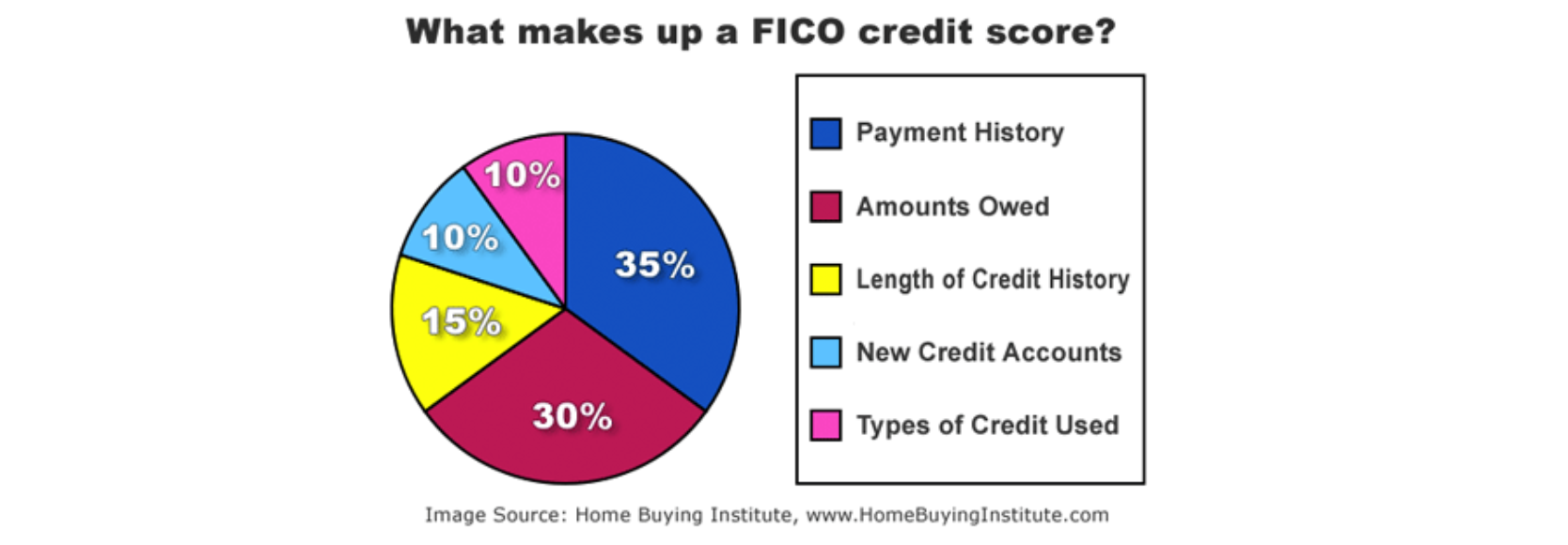

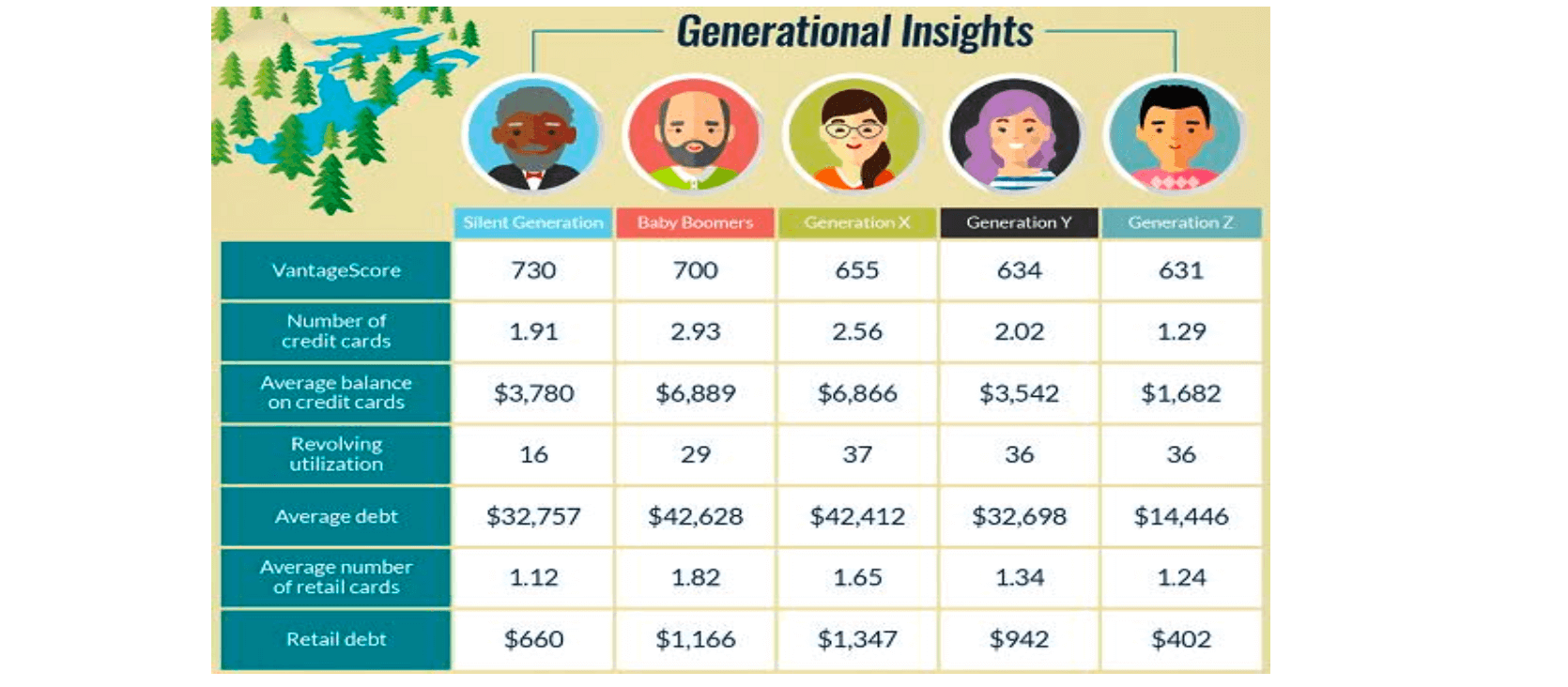

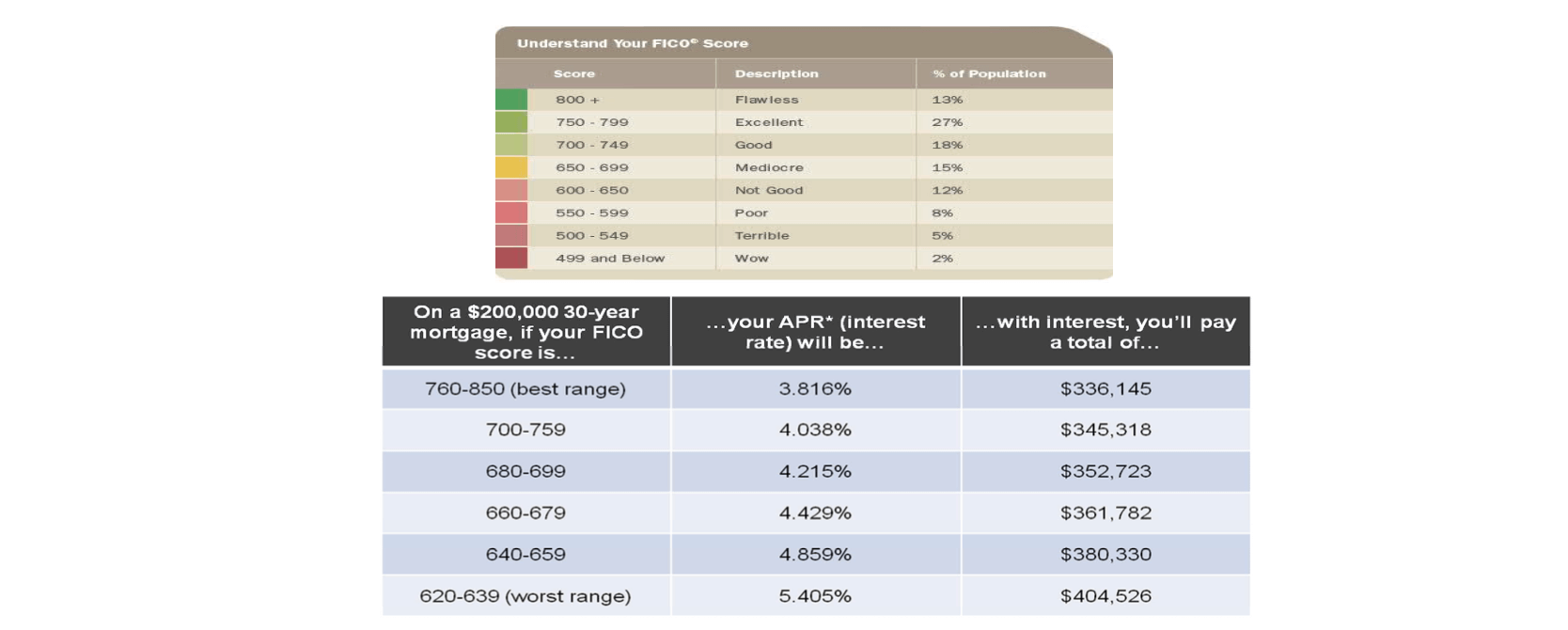

- Fair Isaacs Corporation created FICO, a credit scoring system used in the US

- consider age

- yong or low-income families pay more to buy a house, with a higher mortage interest rate

- if this was a Covid-fatality risk calculator, who would you vaccinate first & why

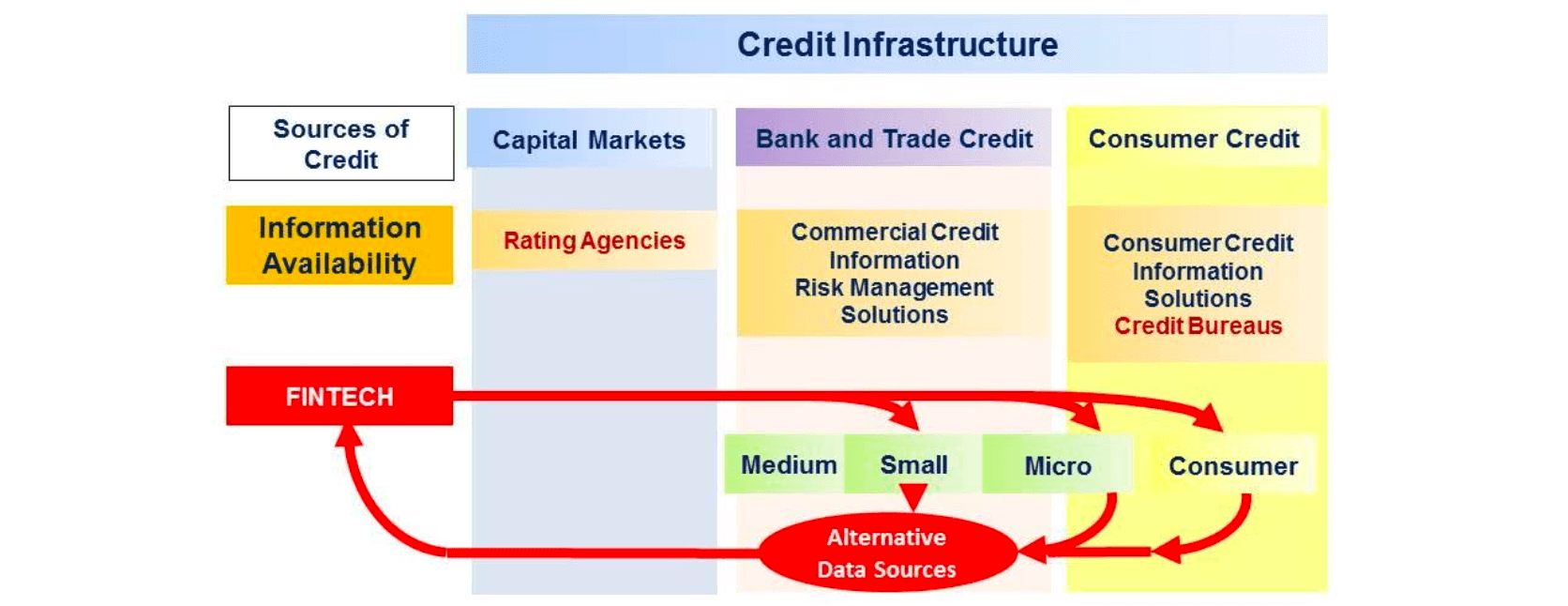

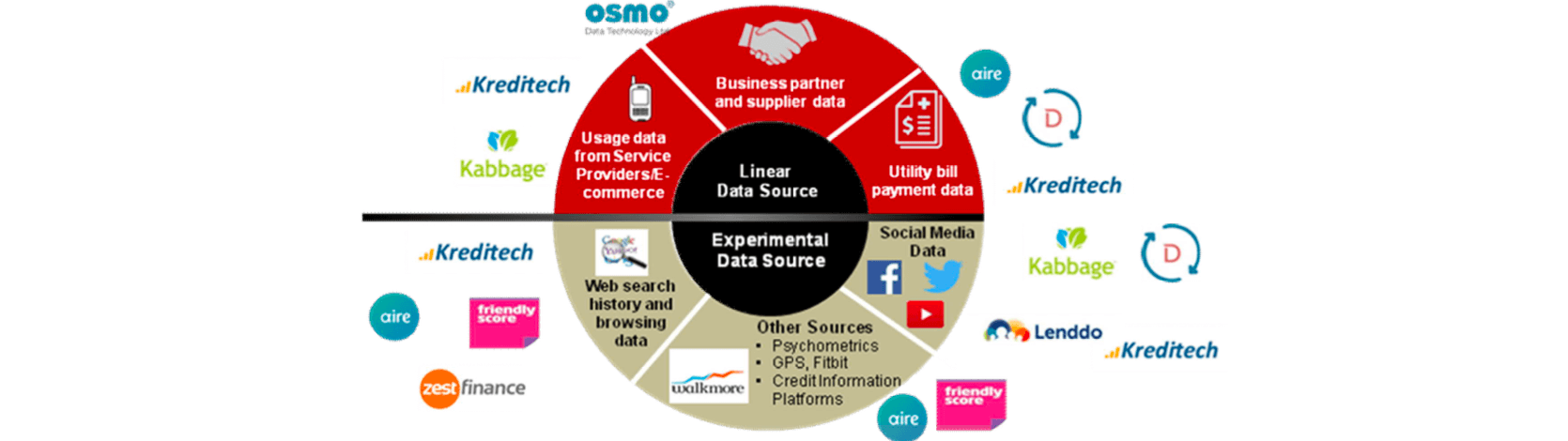

- FinTech - the disrupting force

- different data sources

- applying AI, machine learning and predictive analytics for credit scoring

- different data sources

Bank loans & credit in China

- history

- 1949 all FIs nationalized -> People’s Bank of China

- 1980s Bank of China, Agricultural Bank of China, China Construction Bank, Industrial & Commercial Bank of China established for loans to SOEs

- 2010 all listed on stock exchange, largest banks in the world by market cap, 1⁄2 of total assets in China

- regulatory control of interest rates for insurance and mutual fund products

- 20% of SMEs had access to credit, 60% GDP

- private micro-enterprises of < 10 employees, no credit access

- 2008 PBOC and CBRC microfinance defined

- 2013 village and town 7839 microfinance companies with $131B in loan balance

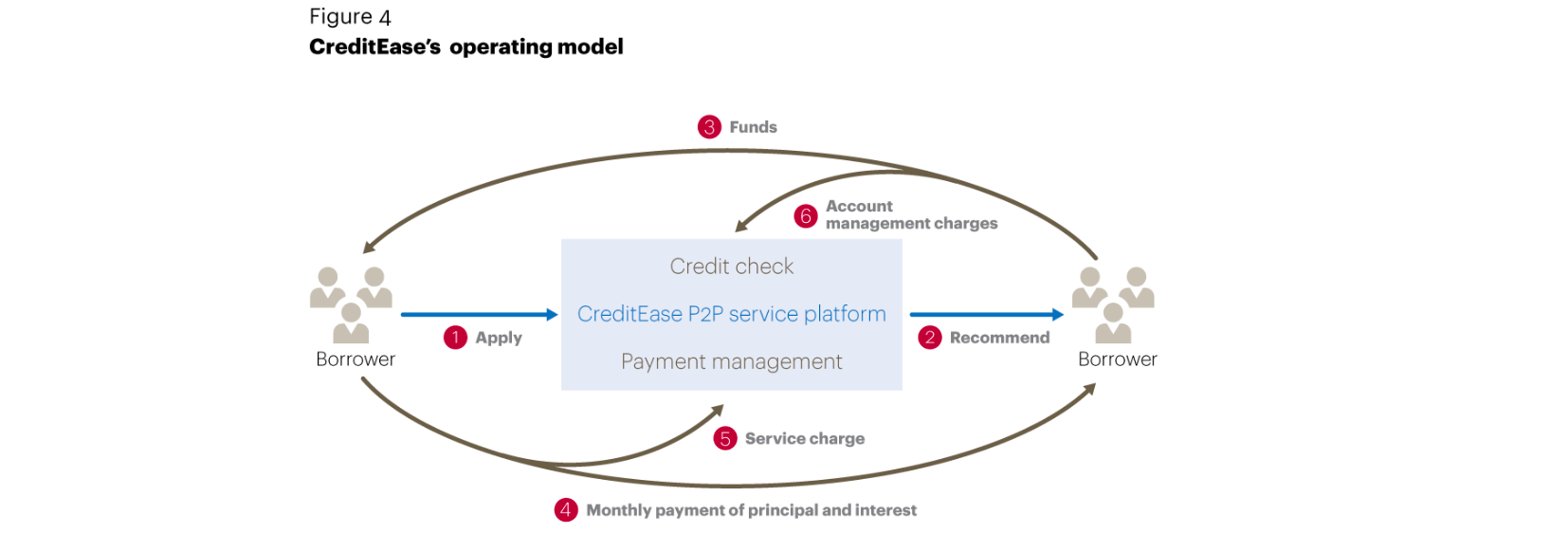

- CreditEase

- poor talented students seeking vocational training at Ning Tang’s (the founder) school

- problem - students can’t afford tuition

- need - speedy credit approval for tuition loan

- risk — default, not paying back

- reward— better-paying jobs increase likelihood of payback

- proxies — grades, attendance, teacher recommendations

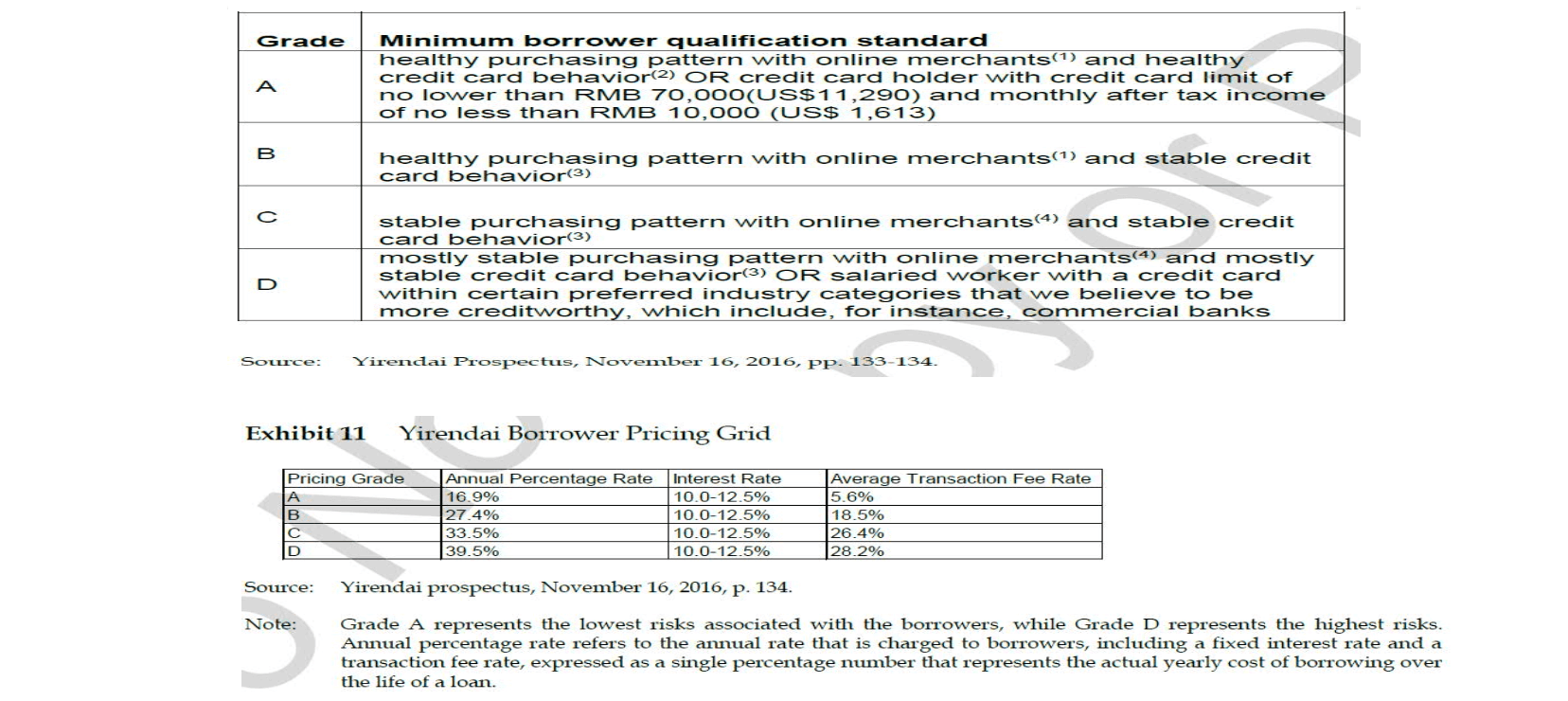

- credit rating system

- P2P lending

- the importance of credit-scoring

- the importance of credit-scoring

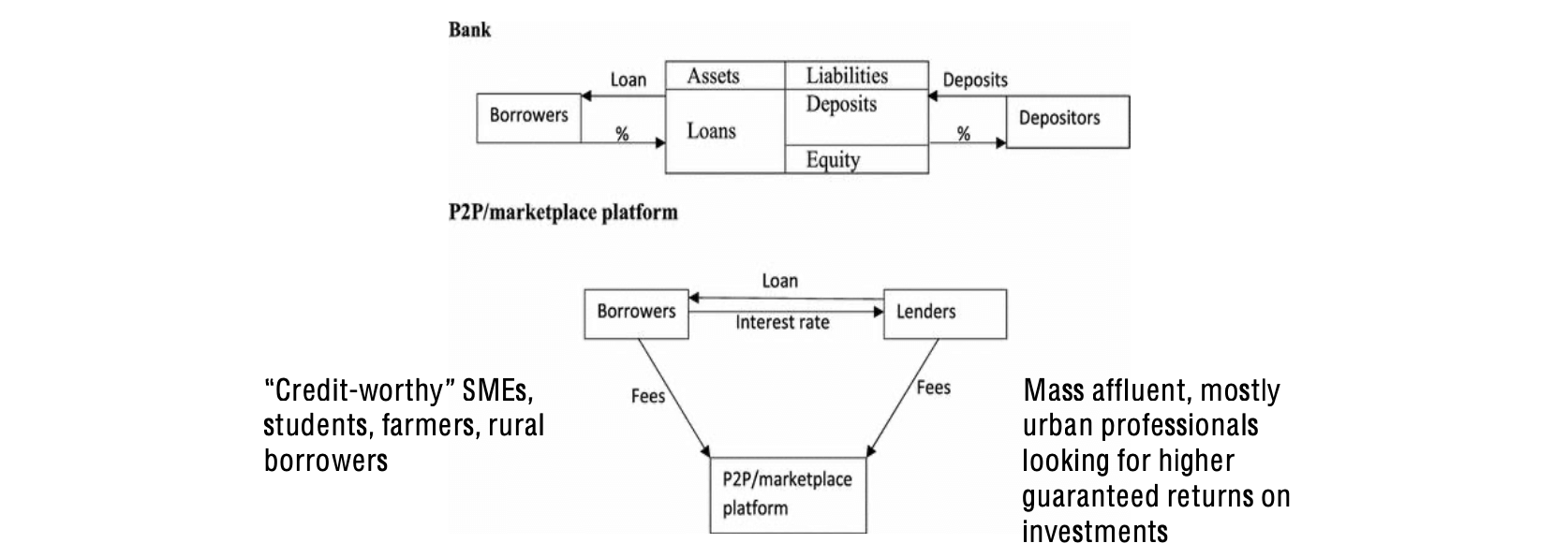

- bank loans vs P2P lending

- the source of money is different

- the risk control of traditional bank is better than that of P2P platform

- Dianrong & sesame credit

- using alternative data - “data exhaust”

- using alternative data - “data exhaust”

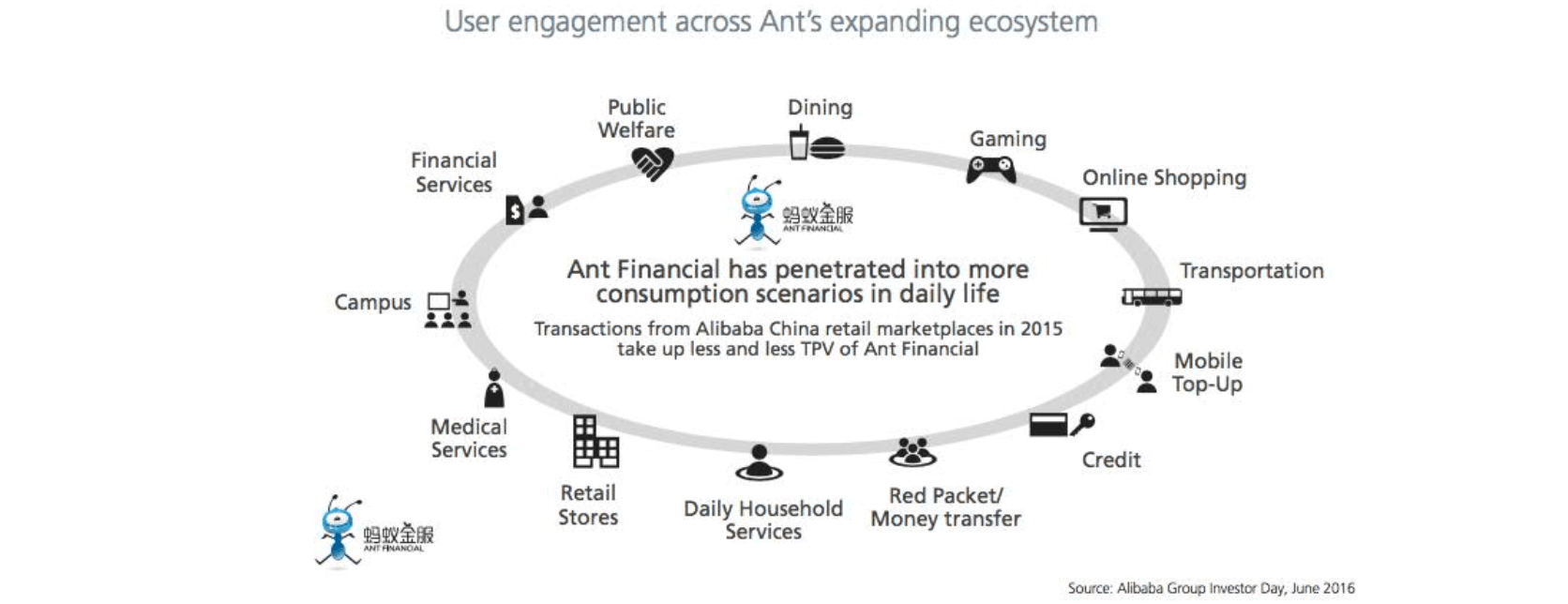

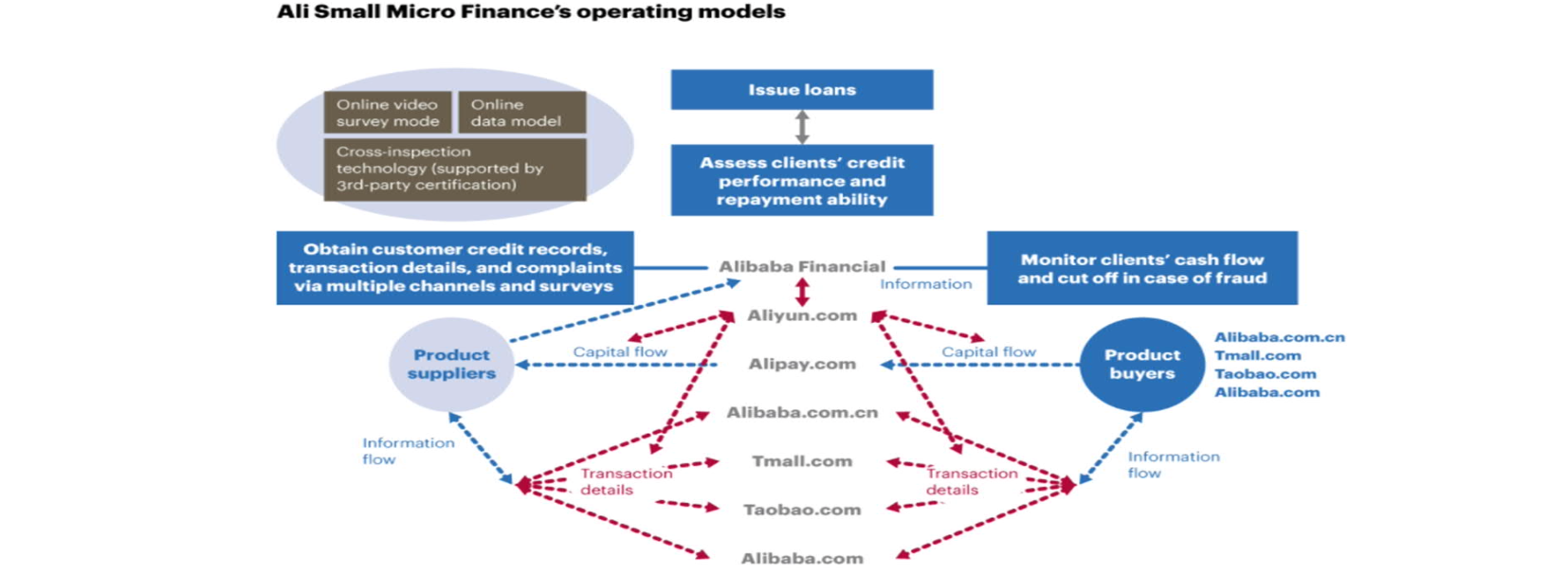

- Ant Financial & sesame credit

- consumption scenarios

- creating real-time datastreams

- consumption scenarios

AI-Enabled Insurance

Overview

- insurance technology

- is an important sector of the financial services industry

- the reason of using InsurTech

- more accurate

- better predictions and better at spotting claims fraud via video, e.g. Lemonade 1 min. claim

- “unbiased”

- reduced agent favoritism or outright corruption, e.g. Ping An Medical Insurance/OneConnect

- fast

- speeds the application and ID verification & approval process and the customer experience, e.g. Ant Financial auto 6 seconds vs 6 days for claims reimbursement

- cheap

- more accessible medical care and emergency payment for rural and underserved areas, e.g. The Good Doctor telemedicine one-minute clinic

- more accurate

Lemonade’s AI bot is easy and fast

-

video description

-

top 5 data questions

- home address

- own or rent

- roommates, fire alarm, burglar alarm

- birthdate

- active renter’s insurance

Ethical Considerations

Assessing the risk of an automated decision making system

- beneficiary

- who is going to gain from the decision being made

- high risk from high benefits for the decision maker

- low risk from low benefits for the individual

- because of a unbalanced situation

- data immutability

- if decisions are made on the basis of characteristics people are born with such as age and ethnic origin

- this is higher risk and more controversial than lifestyle choices such as the music people like or what they watch on TV

- impact

- what effect is a decision going to have

- a life or death decision about cancer treatment is much more important than whether or not to send someone a 10% coupon for frozen pizza

Approaches of using predictive models for “high risk” decisions

- try to identify at risk groups

- separate score distribution reports can be compared to see if certain groups will be adversely treated

- a more fair treatment

- for lower than average scoring groups, constraints and over-ride rules as well as different cut-offs can be set

- continue to monitor the situation once the decision making system goes live

- review score profile and decision rules for key groups

- fine tune cut-offs, constraints, and over-rides

InsurTech

-

Axa - $10k large-loss claims

- video description (until 9'20'')

-

ethical considerations for Axa

- what are the automated decision rules that will use the predictions of the large-claim predictive model

- who might be at-risk groups

- what constraints, over-ride, cut-offs should be set for risk groups

- how to monitor

- how to protect reputation if the large-claim predictive model is used to “screen out” undesirable drivers

-

different legislative regimes

- US utilitarian approach

- personal data can be harvested for business goals

- if there is a problem using a specific type of data, unacceptable bias against a specific group, legislation is enacted to address that concern

- European Union rights based approach

- personal ownership of data, companies have no right to hold or use personal data unless the individual gives permission

- GDPR (General Data Protection Regulations) for EU citizens and transactions, “right to erase”

- US utilitarian approach

Additional Reading

ecom7122 entrepreneurship development and fintech ventures in asia entrepreneurship fintech machine learning insurance technology ethical considerations

874 Words

2021-03-23 17:07