11 minutes

FITE7410 Financial Fraud Analytics Techniques (Part 1)

.png)

Financial Fraud Analytics

Fraud detection models

- classification

- the output is category

- regression

- the output is a real value

Techniques

- statistics techniques

- break-point analysis

- peer-group analysis

- association rule analysis

- linear/logistic regressions

- AI/DM/ML techniques

- supervised learning

- using historical information to retrieve patterns

- required labelled dataset

- unsupervised learning

- using historical information to retrieve patterns

- do not require labelled dataset

- divided into

- clustering - to discover the inherent groupings in the data

- association - to discover rules that describe large portions of the data, find relation

- semi-supervised learning

- deal with pertially labelled data

- social network analysis

- learn and detect characteristics of fraudulent behavior in a network of linked entities

- notes

- these techniques are not mutually exclusive but complement each other

- an effective fraud detection and prevention system may combine the use of different techniques

- supervised learning

Data analytics

- predictive analytics

- logistic regression

- decision tree

- random forest

- neural network

- support vector machines

- descriptive analytics

- clustering

- autoencoder

Statistics Techniques

Descriptive analytics for fraud detection

- outlier detection techniques

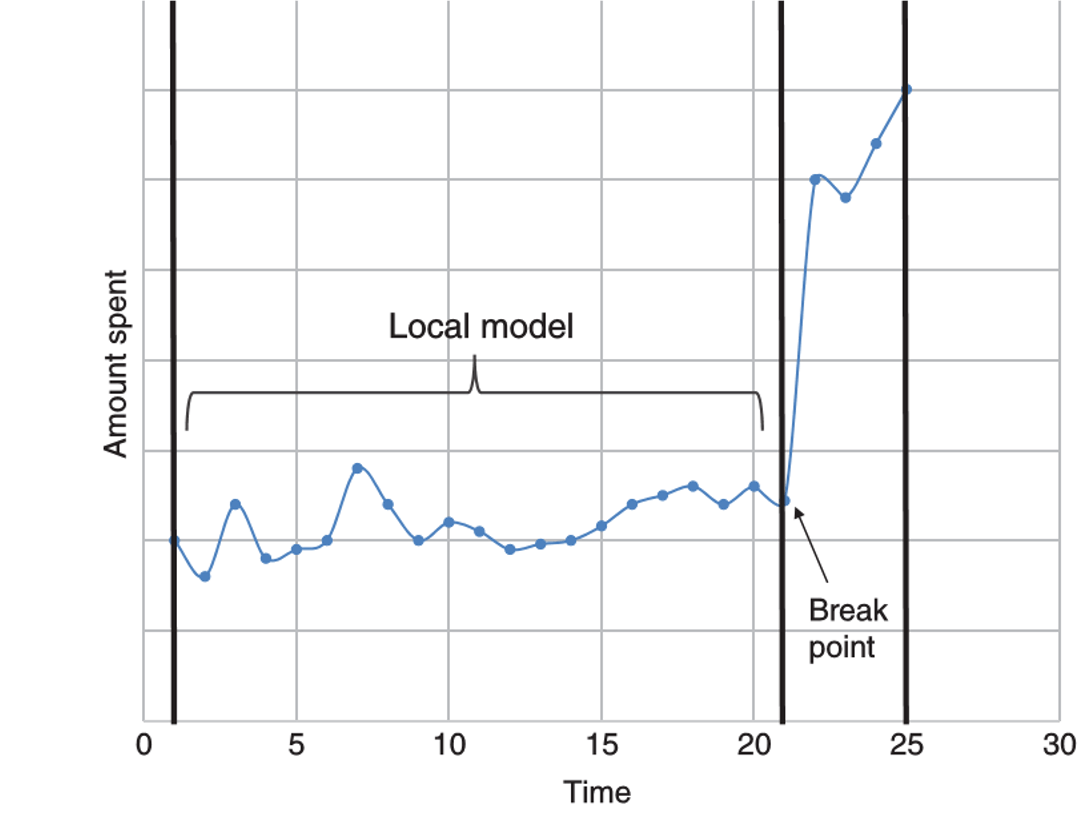

- break-point analysis

- intra-account, indicates by a sudden change in account behavior

- starts from defining a fixed time window

- split the time window into old and new

- old part represents the local model or profile against which the new observations will be compared

- use t-test (mean comparison) to compare the averages of the old and new parts

- observations are ranked according to the t-statistical value

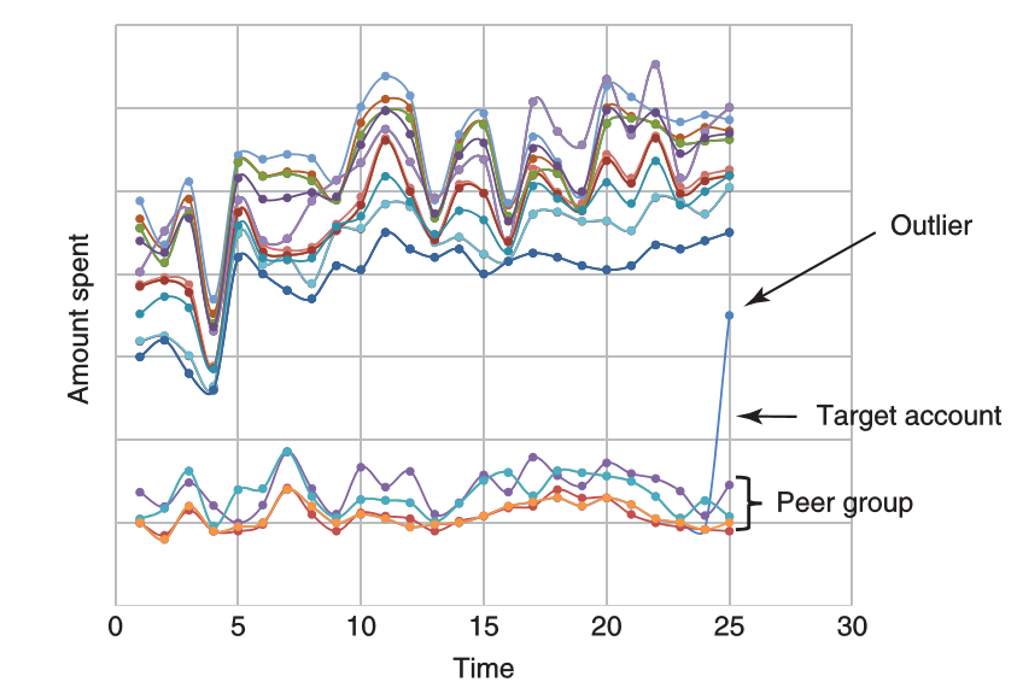

- peer-group analysis

- inter-account, compare with peer-group (nomal behavior)

- identifies the peer group of a target account

- by using prior business knowledge or in a statistical way

- group size cannot be too small (sensitive to noise), or too big (insensitive to local irregularities)

- compares the behaviors of target account with peer accounts, e.g. t-test, any distance metrics

- disadvantage

- the two methods can be used to detect local anomalies rather than global anomalies

- cases may be normal in global population

- these cases are marked as suspicious when compared to local profile or peers (more sensitive to local anomalies)

- the two methods can be used to detect local anomalies rather than global anomalies

- break-point analysis

- relation detection techniques

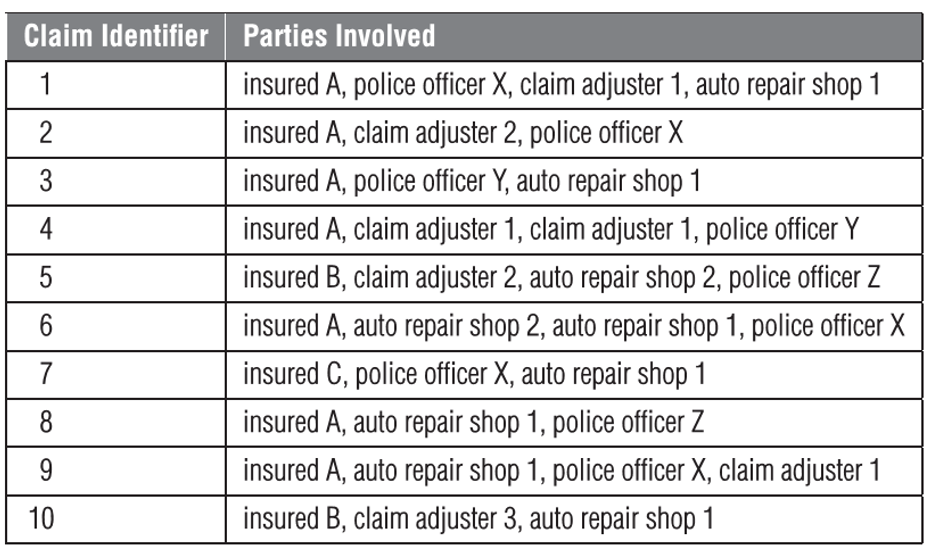

- association rule analysis

- detect frequently occurring relationships between items

- originates from market basket analysis - to detect which items are frequently purchased together

- rules measure correlation associations, should not be interpreted as casual relation

- steps

- identify frequent item sets

- frequency of an item set is measured by means of its support \(support(X) = \frac{number \ of \ transactions \ supporting (X)}{total \ number \ of \ transactions}\)

- example

- item set {insured A, police officer X, auto repair shop 1}

- occurs in claim ID# 1, 6, 9

- support = 3/10 = 30%

- a frequent item set - an item set of which the support is higher than a minimum value (e.g. 10%)

- identify association rules

- strength of the association rule measured by confidence \(confidence(X \rightarrow Y) = P(Y|X) = \frac{support(X \cap Y)}{support(X)}\)

- example

- item set {insured A, police officer X, auto repair shop 1} can have multiple association rules

- if insured A AND police officer X -> auto repair shop 1

- X = {insured A, police officer X}

- \(support(X) = 4/10\) (ID# 1, 2, 6, 9)

- Y = {auto repair shop 1}

- \(support(X\cap Y) = 3/10\) (ID# 1, 6, 9)

- confidence (X -> Y) = 75%

- if insured A AND auto repair shop 1 -> police office X

- if insured A -> auto repair shop 1 AND police office X

- if insured A AND police officer X -> auto repair shop 1

- item set {insured A, police officer X, auto repair shop 1} can have multiple association rules

- selected association rule - a rule of which the confidence is higher than a specified value

- identify frequent item sets

- association rule analysis

Predictive analytics for fraud detection

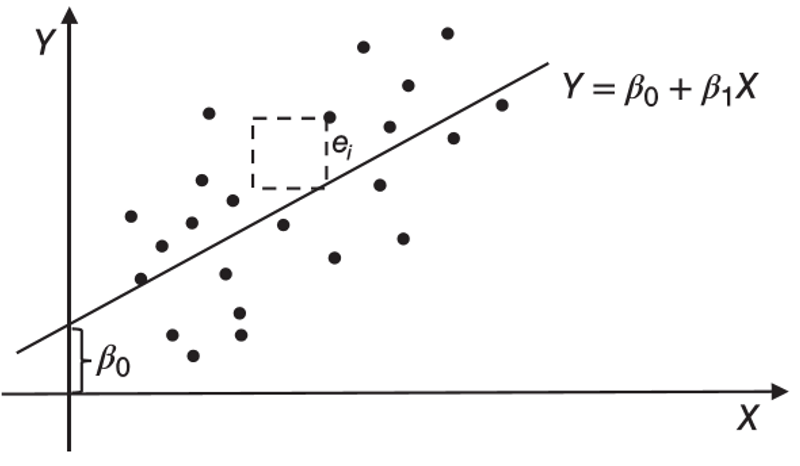

- linear regression

- used to model a continuous target variable

- general formulation:

\(Y = \beta_0 + \beta_1 X_1 + \cdots + \beta_N X_N\)

- slope: positive or negative relation between X and Y

- \(\beta_1\ldots\beta_N\): regression coefficient of a variable

- \(\beta_0\): intercept coefficient, excepted mean value of Y when all X = 0

- minimize the sum of all error squares (MSE = mean square error) to find the best fit straight line

- advantages

- performs exceptionally well for linearly separable data

- operationally efficient and easy to interpret & implement

- extrapolation beyond a specific dataset

- disadvantages

- target and exploratory variables must be of linear relation

- prone to noise and overfitting (a better fitting of the training dataset than the testing dataset)

- sensitive to outliers

- assumes exploratory variables are independent, might have problem of multicollinearity

- some variables are correlated, may have errors

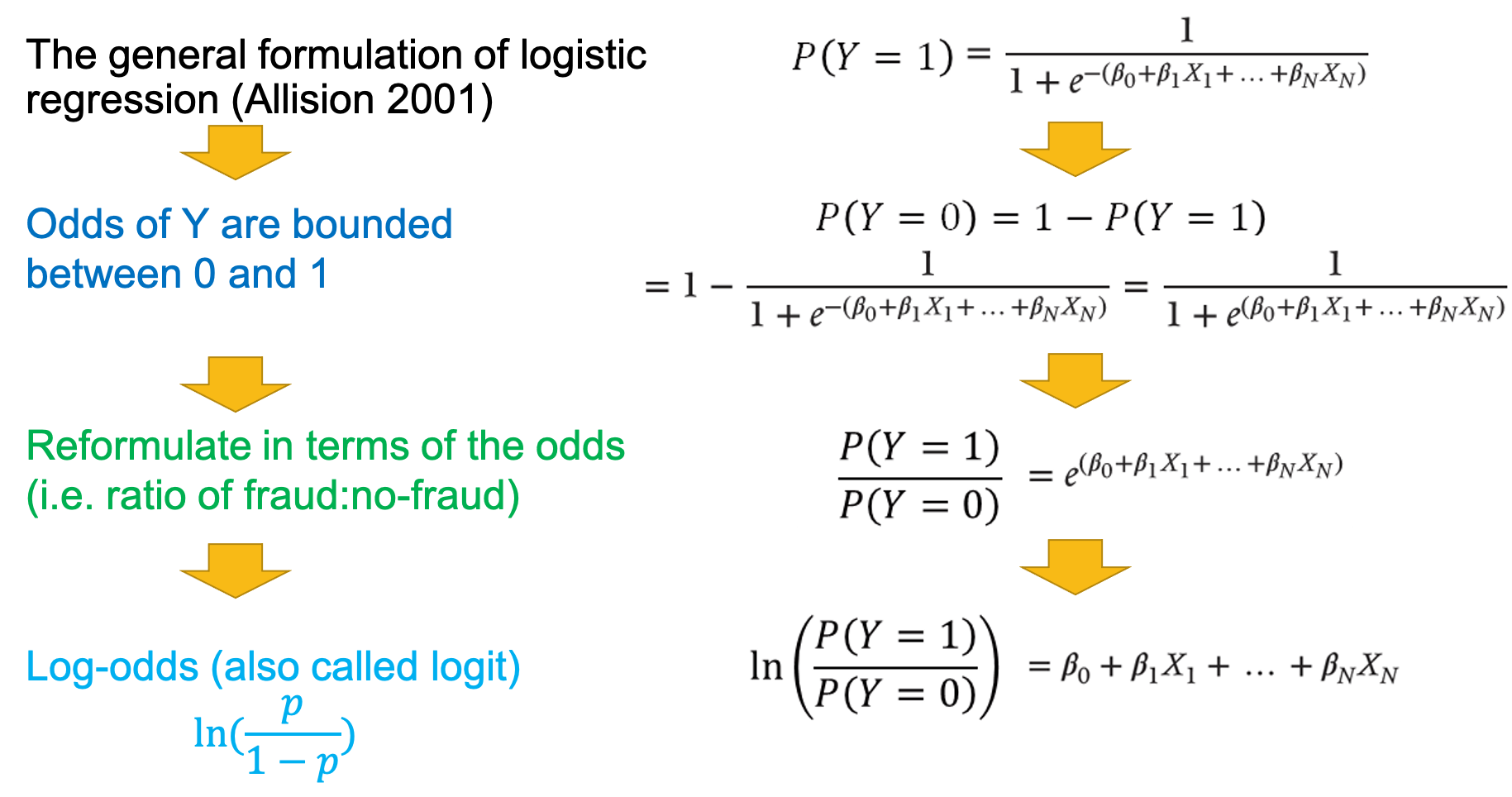

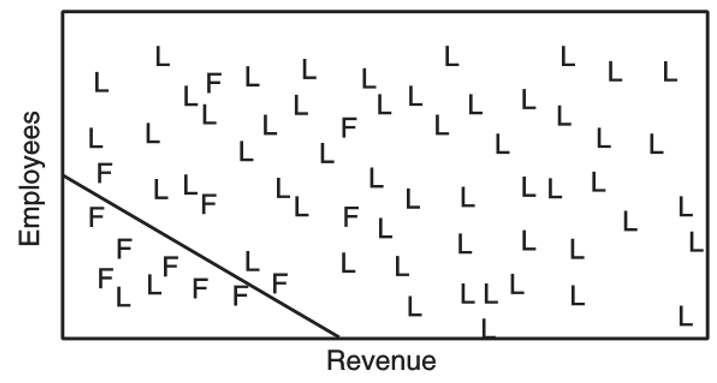

- logistic regression

- can be used for classification problem where the target variable assumes a value between 0 or 1 (boundaries)

- \(P(Y=1)=1-P(Y=0)\)

- steps

- optimize the maximum likelihood estimation (MLE) - chooses the parameters in such a way as to maximize the probability of getting the sample at hand, in order to find the best fit straight line

- interpret result

- linear in log odds (logit)

- estimates a linear decision boundary between the two classes

- advantages

- performs exceptionally well for linearly separable data

- operationally efficient and easy to implement

- a good baseline to measure performance of other more complex fraud detection model

- disadvantages

- nonlinear problem cannot be solved

- prone to overfitting

- difficult to capture complex relationships

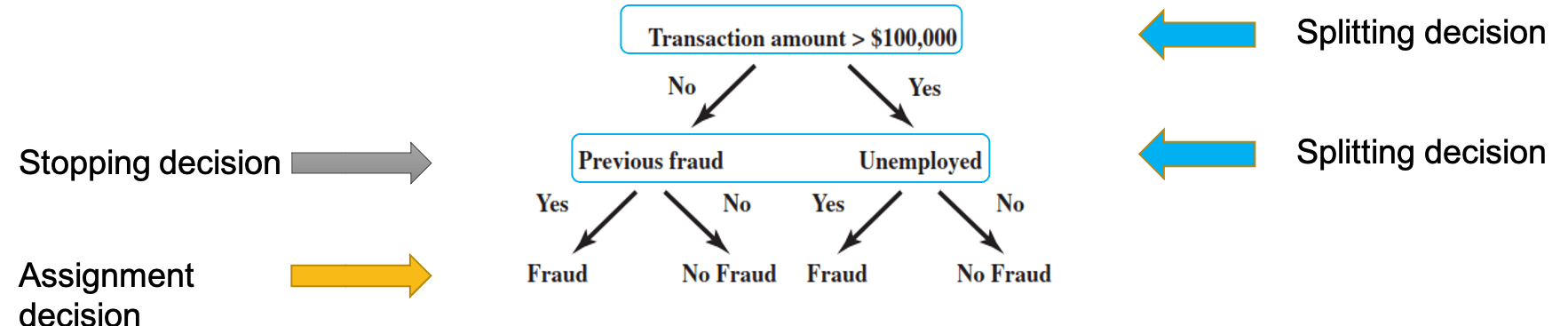

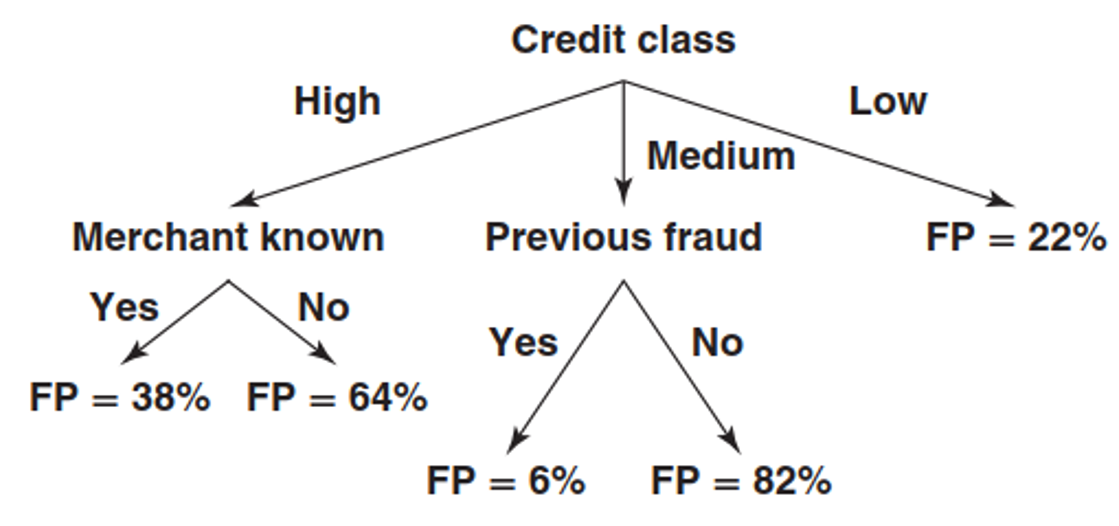

Decision Tree

Overview

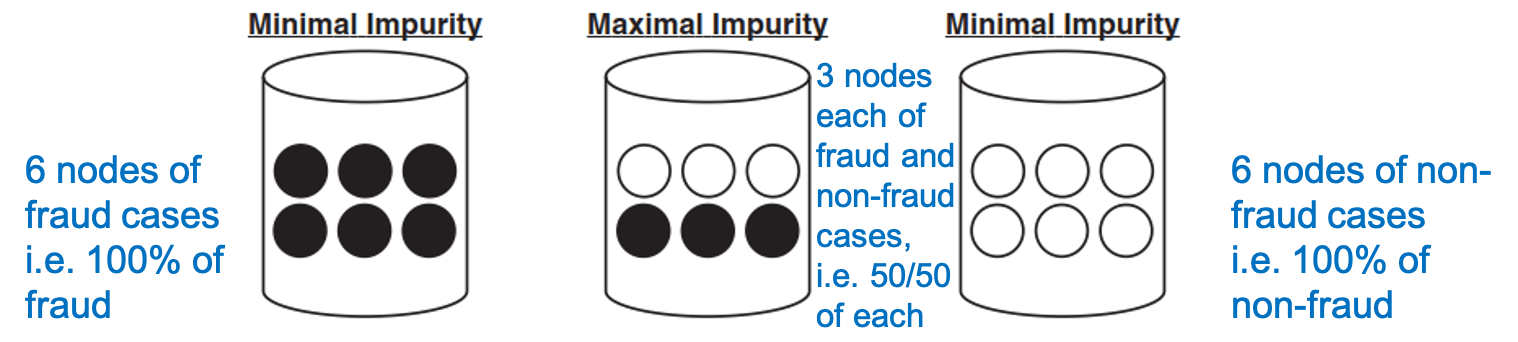

- basics

- aims

- minimize "impurity" in the data

- impurity

- the node impurity is a measure of the homogeneity of the labels at the node

- the node impurity is a measure of the homogeneity of the labels at the node

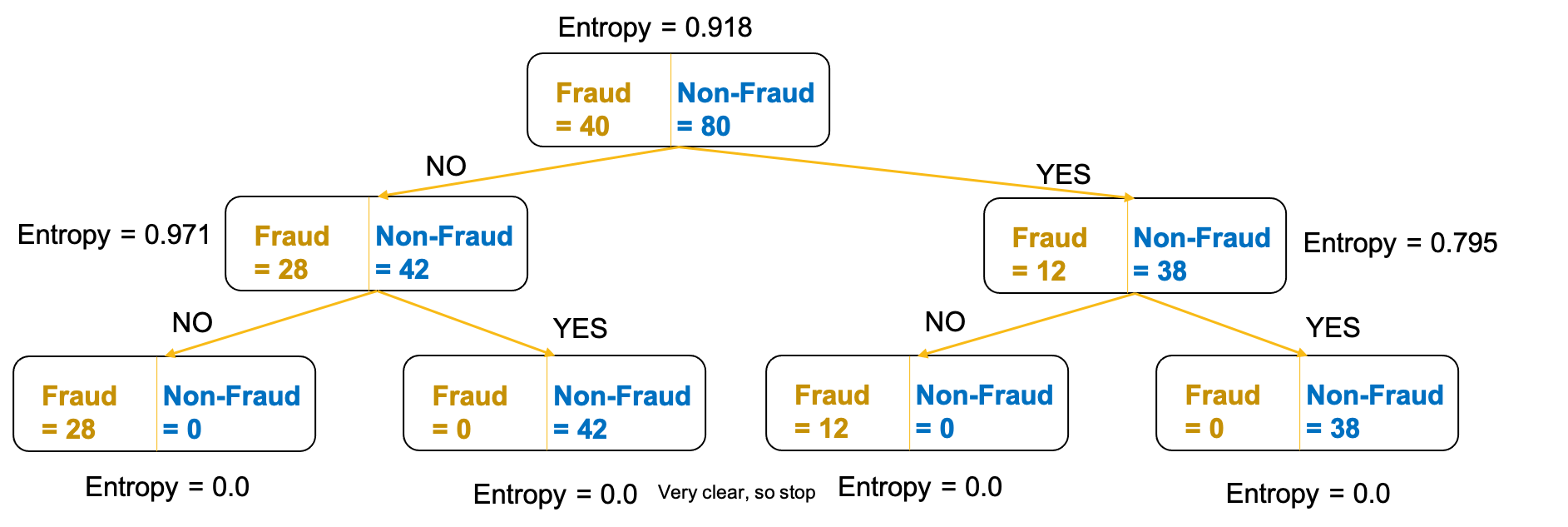

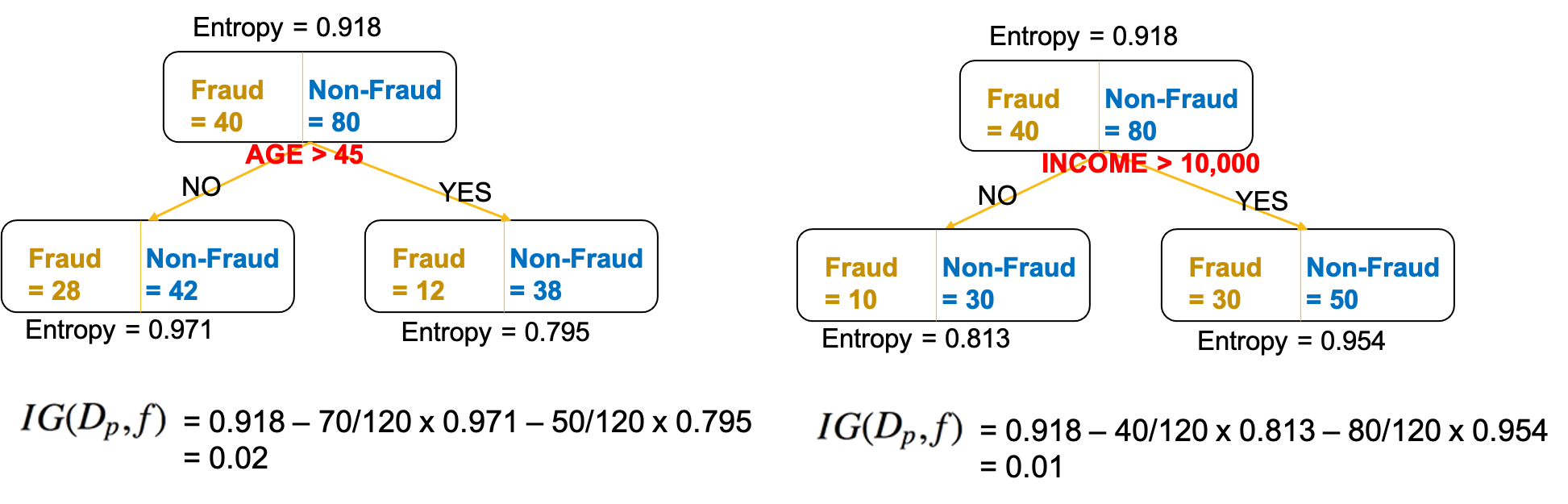

Splitting decision

categorical variables - decision tree

- Gini impurity

- entropy

example

- formula

\[IG(D_p,f)=I(D_p)-\frac{N_{left}}{N}I(D_{left})-\frac{N_{right}}{N}I(D_{right})\]

- compare the IG for splitting decision using the attribute "AGE" and "INCOME"

- IG(AGE) > IG(INCOME) -> use AGE as the splitting attribute

- formula

continuous variables - regression tree

- mean square error (MSE)

- variance

- regression tree splits - favour homogeneity within node and heterogeneity between nodes

- example - favour low MSE in a leave node

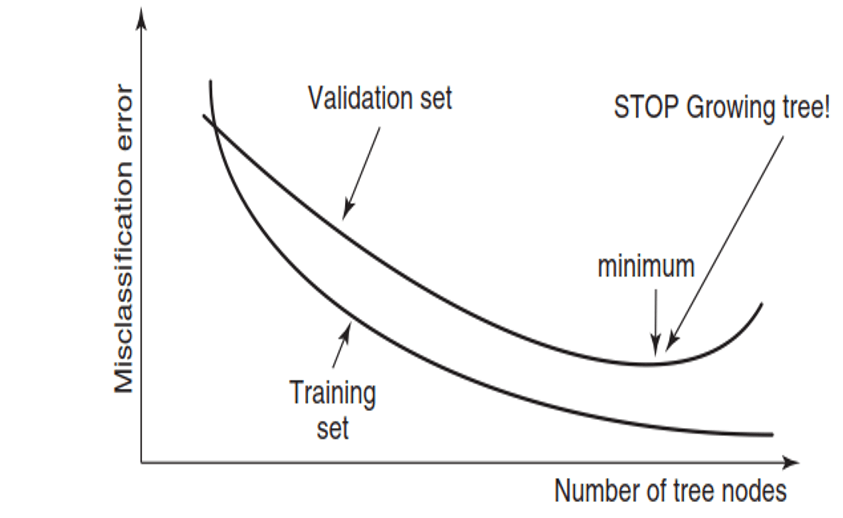

Stopping decision

- aims

- avoid overfitting, the tree would be too complex and fails to correctly model the noise free pattern or trend in the data

- steps

- split the data into training set and validation set (usually 7:3)

- stop growing the tree when the misclassification error for validation set reaches its minimal value

Comparison

- advantages of decision tree

- easy to understand and interpret

- useful in data exploration

- less data clearing required - robust to outliers in inputs and no problem with missing values

- data type not a constraint - can handle both continuous and categorical data for both input and target data

- automatically detects interactions, accommodates nonlinearity and selects input variables

- disadvantages of decision tree

- prone to overfitting

- splitting turns continuous input variables into discrete variables

- unstable fitted tree - small change in the data result in a very different series of splits - sensitve to the dataset

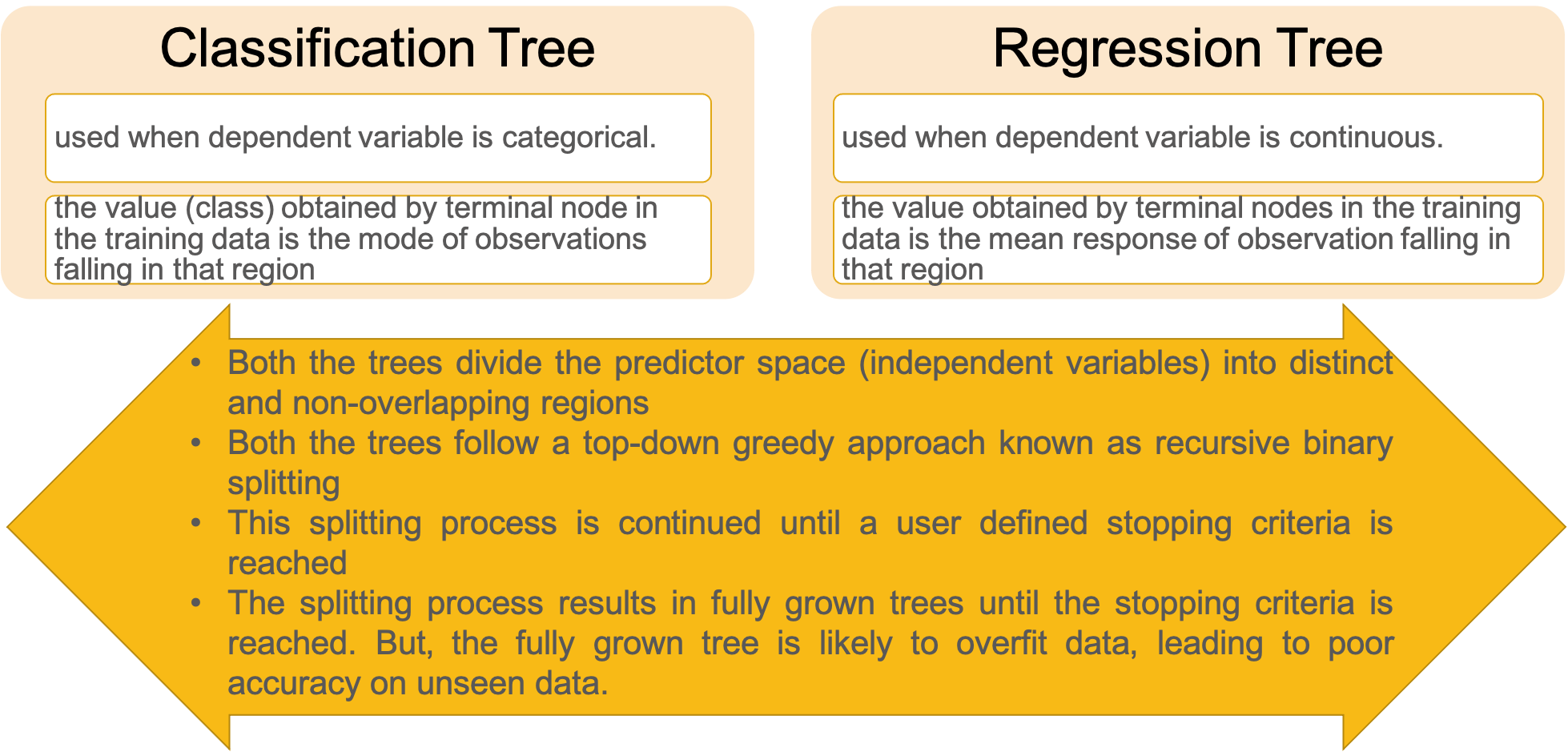

- classification vs regression tree

Ensemble Methods

Overview

- definition

- a machine learning model that involve a group of prediction models (not only one model)

- reasons of using ensemble learning

- performance: better predictions than any single contributing model

- robustness: reduce the spread or dispersion of the predictions and model performance

Bootstrap sampling

- definition

- smaller sample of same size are repeated drawn, with replacement, from the larger original sample

- procedures

- choose a number of bootstrap samples to perform

- choose a sample size

- for each bootstrap sample

- draw a sample with replacement with the chosen size

- calculate the statistic on the sample

- calculate the mean of the calculated sample statistics

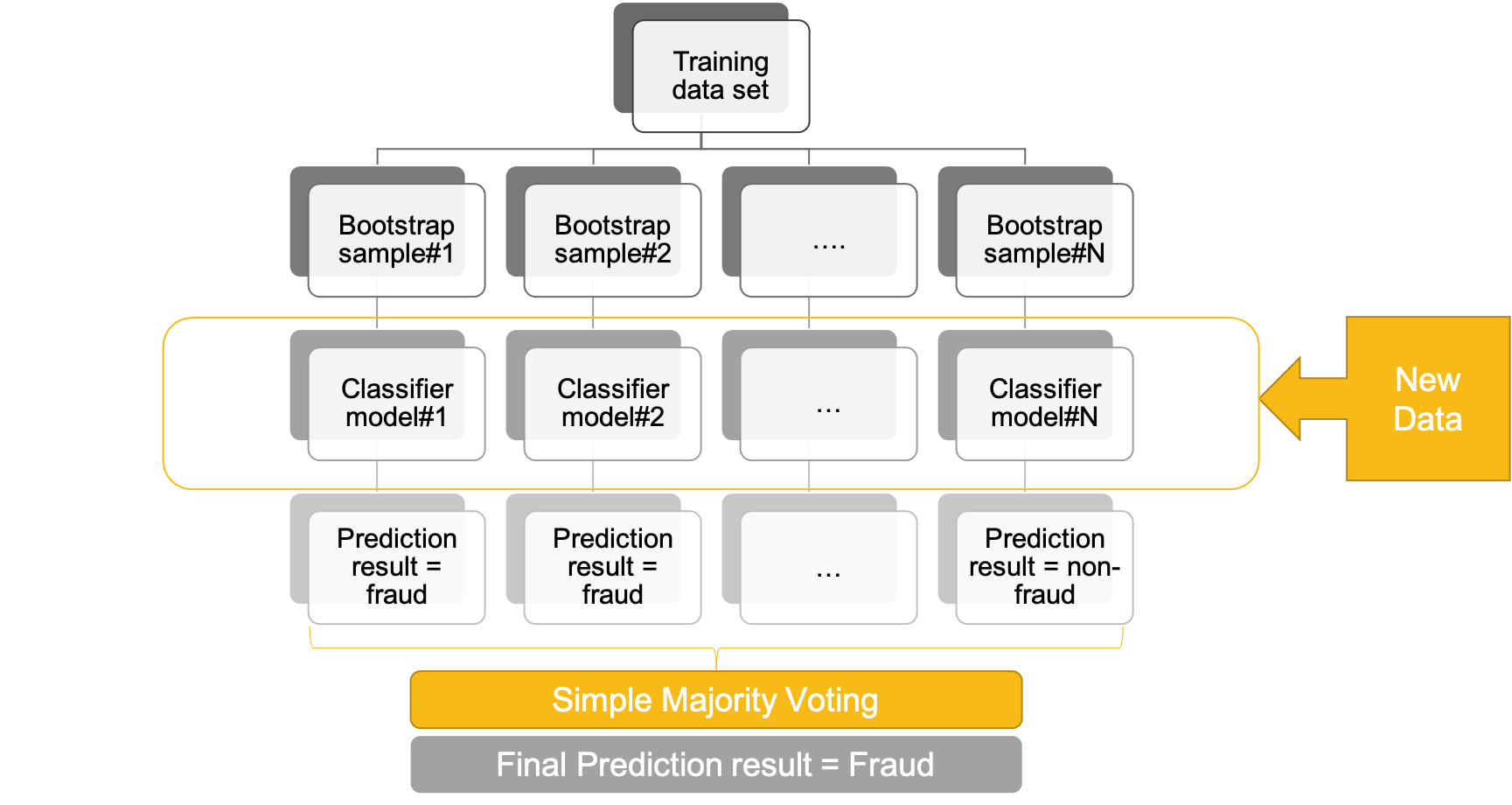

- bagging (bootstrap aggregating)

- take N number of bootstraps from the underlying sample

- build a classifier

- for classification -> major voting

- for regression -> calculate the average of the outcome of the N prediction models

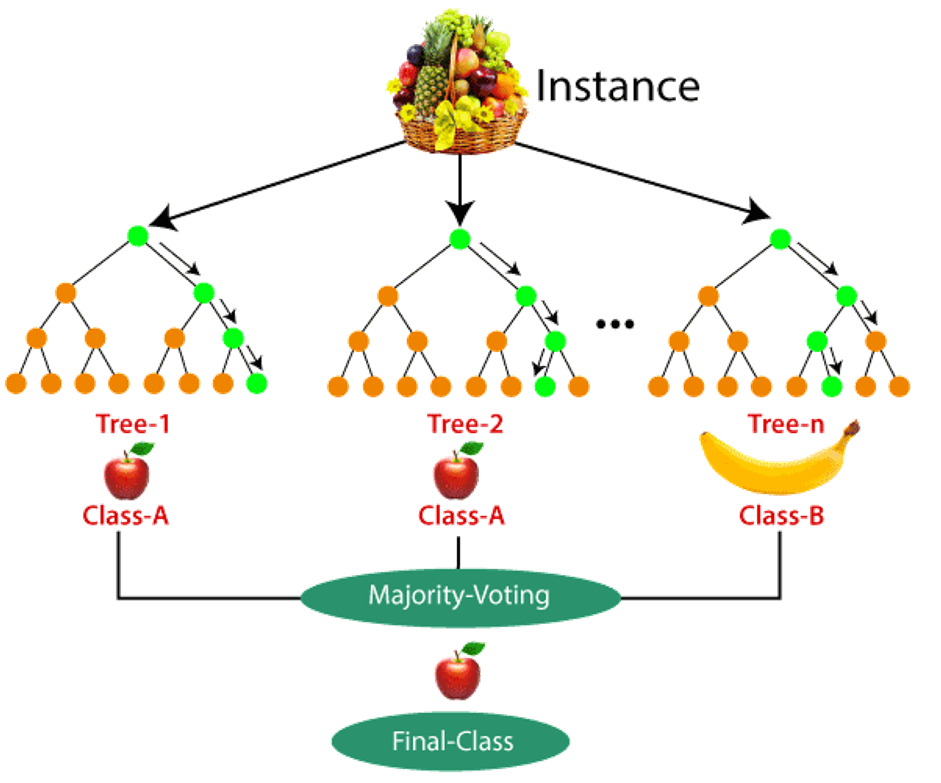

Random Forest

Overview

- definition

- is a forest of decision trees

- can be used for both classification tree and regression tree

- achieve dissimilarities among the decision trees by

- adopting a bootstrap procedure to select training samples for each tree (the same dataset -> useless)

- selecting a random subset of attributes at each node

- training different base models of decision trees

- result of random forest is a model with better performance compared to a single decision tree model

Comparison

- advantages

- random forest can achieve excellent predictive performance and suitable for the requirements of fraud detection

- capable of dealing with data sets having only a few observations, but with lots of variables

- disadvantages

- it is a black-box model, more complicated actually

- variable importance can be used to understand the internal workings of random forest (or any ensemble model)

- it is a black-box model, more complicated actually

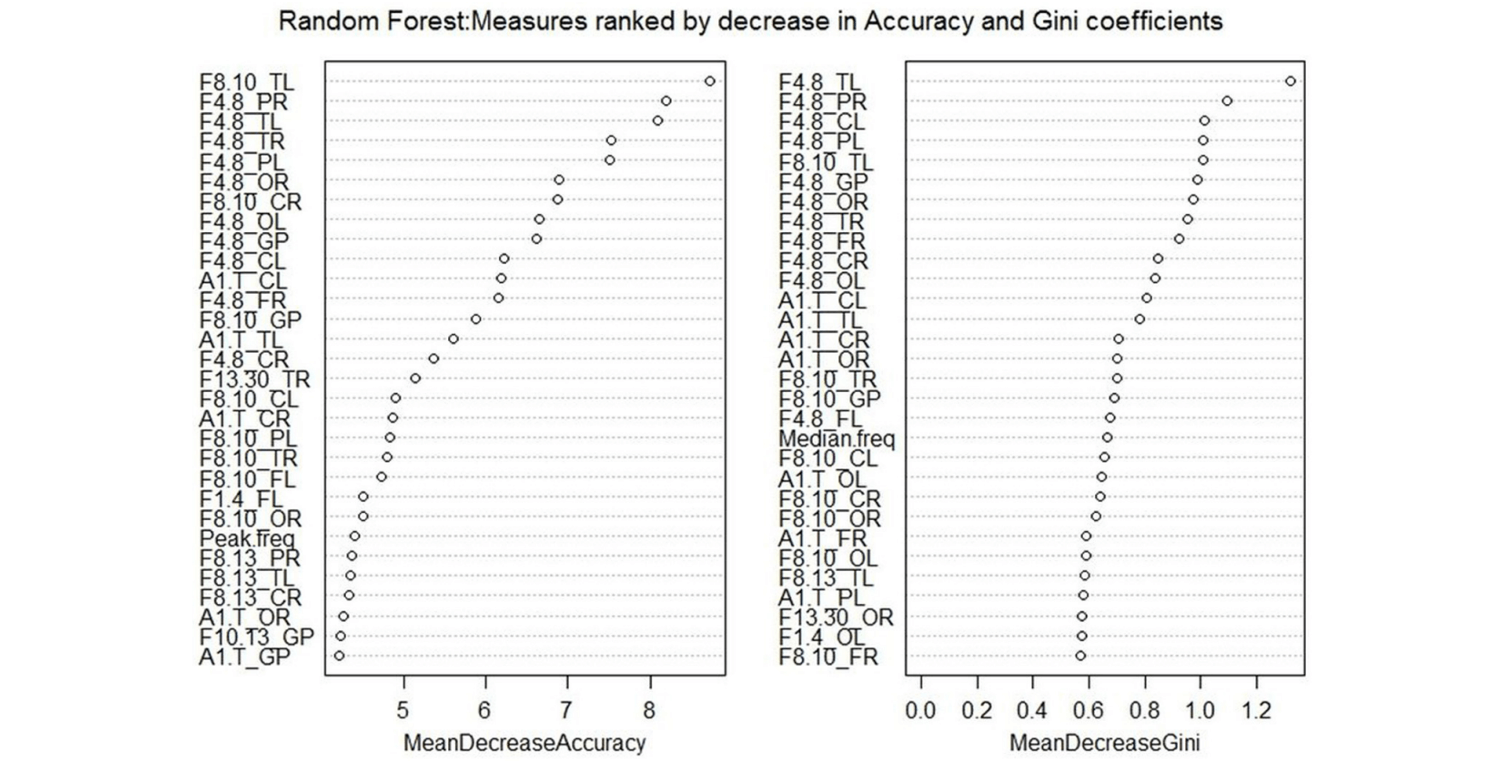

Variable importance

- aims

- when get result from random tree, which variables have the most predictive power

- variables with HIGH importance can be used for further analysis, while variables with LOW importance can be discarded

- example - provide two mechanism, which one should be used, it depends

Performance Evaluation

Split the sample data

- training dataset

- training data - to build the model

- validation data - to be used during model development (e.g. making stopping decision in decision tree)

- testing data - to test the performance of the model

- splitting the dataset

- observations used for training should not be used for testing or validation

- training:(validation):testing (not strict, it depends)

- 7:3 (validation dataset is not required)

- 4:3:3 (validation dataset is required)

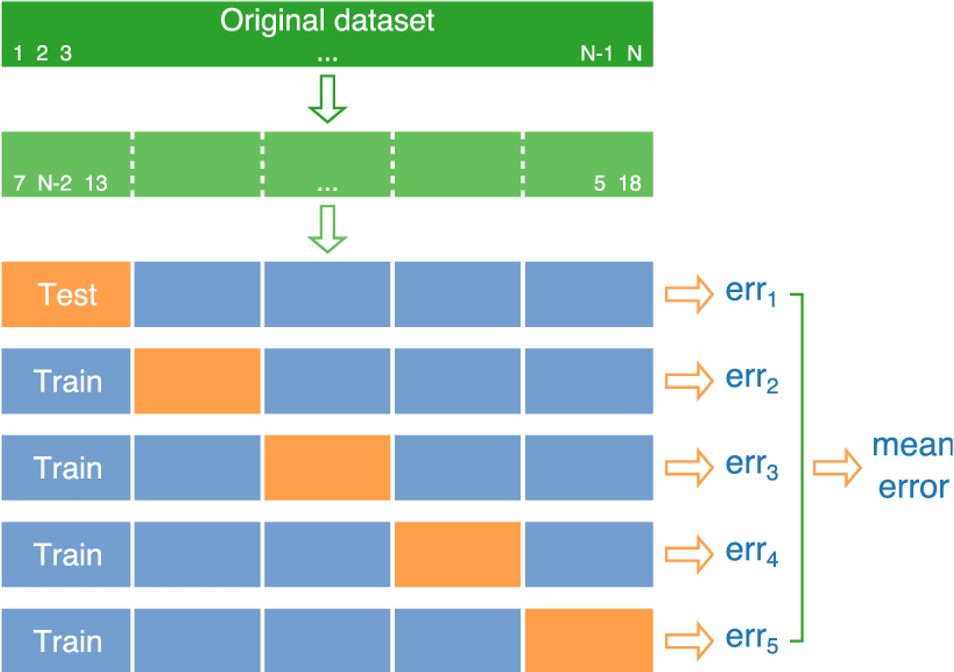

- k-fold cross-validation

- can be applied when the sample size is small

- procedures (k = 5)

- original dataset (shown in dark green) is randomly partitioned into k disjoint sets (shown in light green)

- then k − 1 parts are used for training a model (shown in blue) and remaining part is used for evaluation (shown in orange)

- this process is repeated k times for all possible choices of the test set, producing test errors

- the final performance is reported by averaging the errors from each iteration

- with more than one trained model, which one should be chosen

- similar to ensemble method, use voting procedure

- use leave one out cross-validation and randomly select one model

- randomly select

- using all data except dropped one for training

- since all models differ by one observation only, the performance should be similar for all models

- use all observations for training

- then, use the cross-validation performance result (mean error) as the independent estimate of the model

- only use when the sample size is really extremely small (no choice option)

Model evaluation

classification model

- statistics measure

- correlation tests

- comparison of mean tests

- regression tests

- non-parametric tests

performance metric

- mainly used in machine learning evaluation

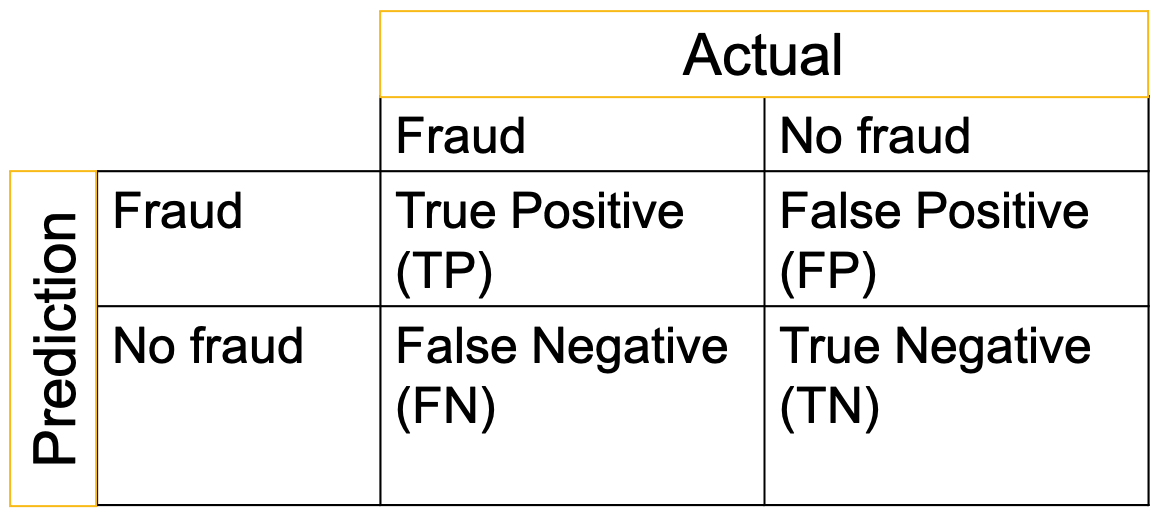

the confusion matrix

- accuracy: percentage of total items classified correctly

\[Classification\ accuracy=\frac{TP+TN}{TP+FP+FN+TN}\]

- error: percentage of total items classified incorrectly

\[Classification\ error=\frac{FP+FN}{TP+FP+FN+TN}\]

- recall: how many fraudsters are correctly classified as fraudsters (most important, i.e. favour TP > FN)

\[Sensitivity=Recall=Hit\ rate=\frac{TP}{TP+FN}\]

- precision: how many predicted fraudsters are actually fraudsters (useful if the objective is not to leave out important information, e.g. spam mail detection, i.e. TP > FP)

\[Precision=\frac{TP}{TP+FP}\]

- F1 score: the weight average of precision and recall (take into account FP and FN, thus more informative than accuracy)

\[F-measure=\frac{2\times (Precision\times Recall)}{Precision+Recall}\]

- for fraud detection models, recall is most useful performance measure

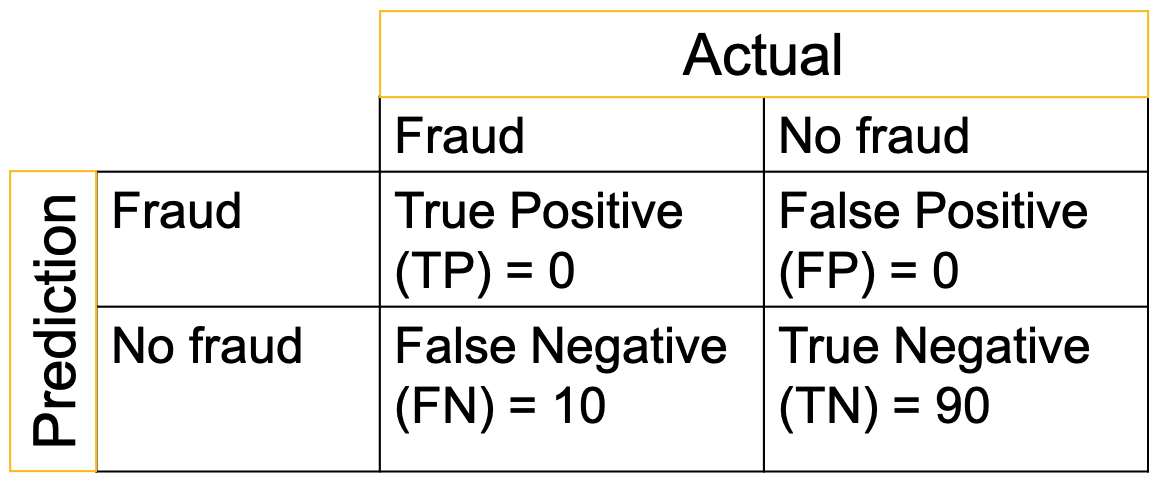

example

\[Accuracy = \frac{0+90}{100}=90\%\]

- even with very high accuracy, this model is useless in detecting fraud cases, because no fraud cases are detected by this model

- accuracy: percentage of total items classified correctly

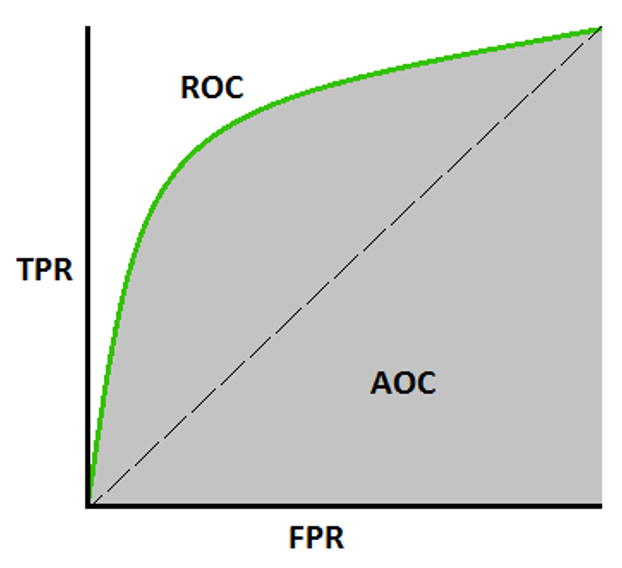

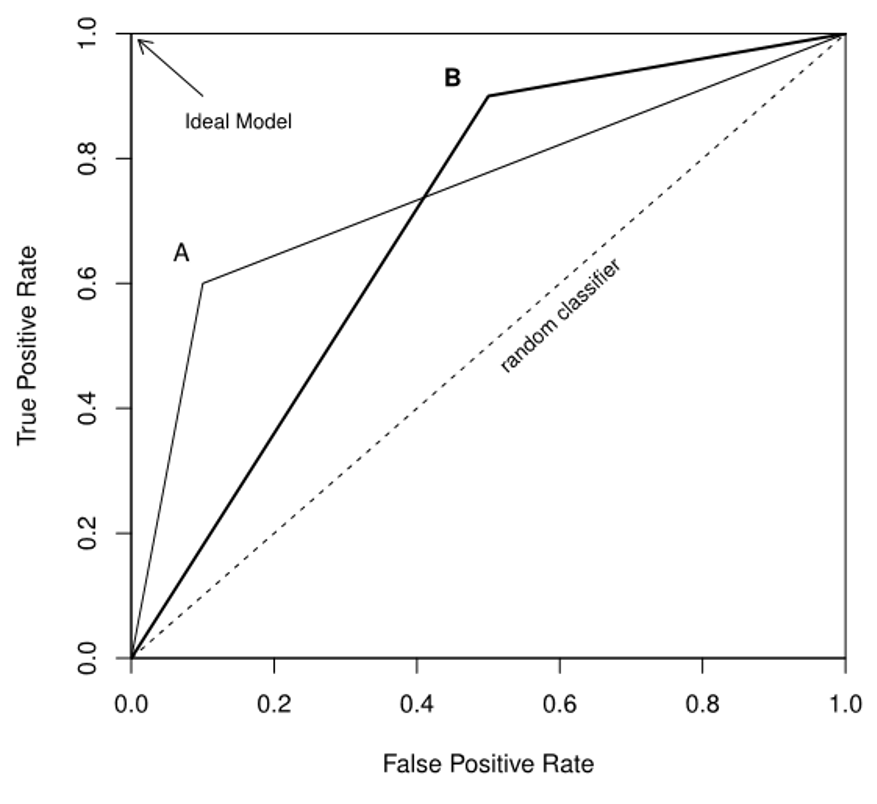

ROC-AUC

- basic terms

- ROC = Receiver Operating Characteristics

- AUC = Area Under the ROC Curve

- \(True Positive Rate (TPR) = Sensitivity=Recall=Hit\ rate=\frac{TP}{TP+FN}\)

- \(True Negative Rate (TNR) = Specificity = \frac{TN}{FP + TN}\)

- \(False Positive Rate (FPR) = 1 - Specificity\)

- ROC curve

- a curve of probabilities

- with TPR as y-axis and FPR as x-axis

- example

- AUC is always between 0 and 1

- calculate the area of the curve and compare which one is better

- AUC = 1 = ideal situation where all fraud and no fraud cases are correctly predicted

- AUC = 0.5 (i.e. diagonal curve) = random guesses, i.e. no discrimination power between fraud and no fraud cases

- any curves under the diagonal curve = no use

- basic terms

any measures that are applicable for the model developed

- statistics measure

regression model

- MAE (Mean Absolute Error)

- \(y_i\) is the actual expected output and \(\hat{y_i}\) is the model's prediction

- simplest but not popular

\[MAE=\frac{1}{N} \displaystyle \sum^{N}_{i=1} |y_i - \hat{y_i}|\]

- MSE (Mean Squared Error)

- more sensitive to outliers, compared with MAE

\[MSE=\frac{1}{N} \displaystyle \sum^{N}_{i=1} {(y_i - \hat{y_i})}^2\]

- RMSE (Root Mean Squared Error)

- due to squared error terms in MSE

\[RMSE=\sqrt{\frac{1}{N} \displaystyle \sum^{N}_{i=1} {(y_i - \hat{y_i})}^2}\]

- r-squared

- also called coefficient of determination

- explains the degree to which the input variables explain the variation of the output/predicted variable

- limitation: either stay the same or increases with the addition of more variables, even if they do not have any relationship with the output variables

\[R^2=1-\frac{SS_{RES}}{SS_{TOT}}=1-\frac{\sum_i {(y_i-\hat{y_i})}^2}{\sum_i {(y_i-\bar{y})}^2}\]

- adjusted r-squared

- N is the total sample size (number of rows) and p is the number of predictors (number of columns)

- overcome the R-squared limitation

- for building linear regression on multiple variables, suggest to use this method to judge

- but for only one input variable, r-squared and adjusted r-squared are same

\[Adjusted \ R^2=1-\frac{(1-R^2)(N-1)}{N-p-1}\]

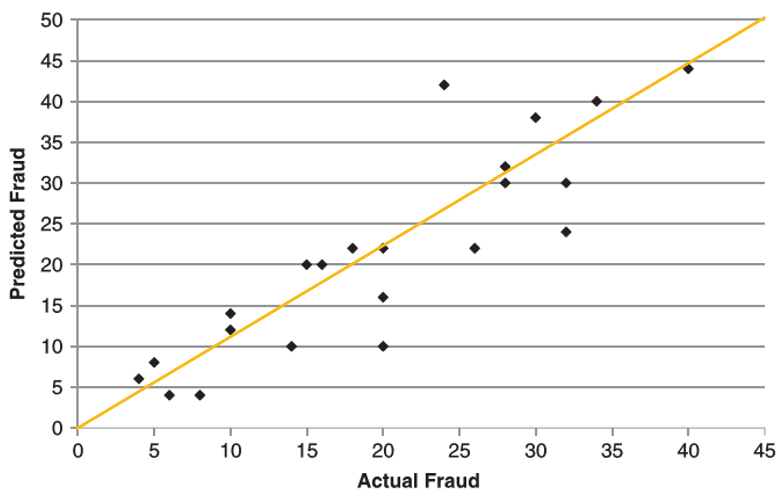

scatter plot

- the more the plot approximately a straight, the better the performance of the regression model

- the more the plot approximately a straight, the better the performance of the regression model

Pearson correlation coefficient

- varies between -1 and +1

- closer to +1 indicates better agreement

\[corr(\hat{y},y)=\frac{\sum^n_{i=1}(\hat{y_i}-\bar{\hat{y}})(y_i-\bar{y})}{\sqrt{\sum^n_{i=1}{(\hat{y_i}-\bar{\hat{y}})}^2}\sqrt{\sum^n_{i=1}{(y_i-\bar{y})}^2}}\]

- MAE (Mean Absolute Error)

comparison

- for classfication model

- the output is categorical data

- the measure of the performance is counting the % of correctly predicted value

for regression model

- the outout is a continuous number

- the measure of the performance is how "close" the predicted value is to the actual value, any deviation from the actual value is an error

\[Error=Y(actual)-Y(predicted)\]

- for classfication model