5 minutes

FITE7410 Forensic Accounting and Fraud Investigation

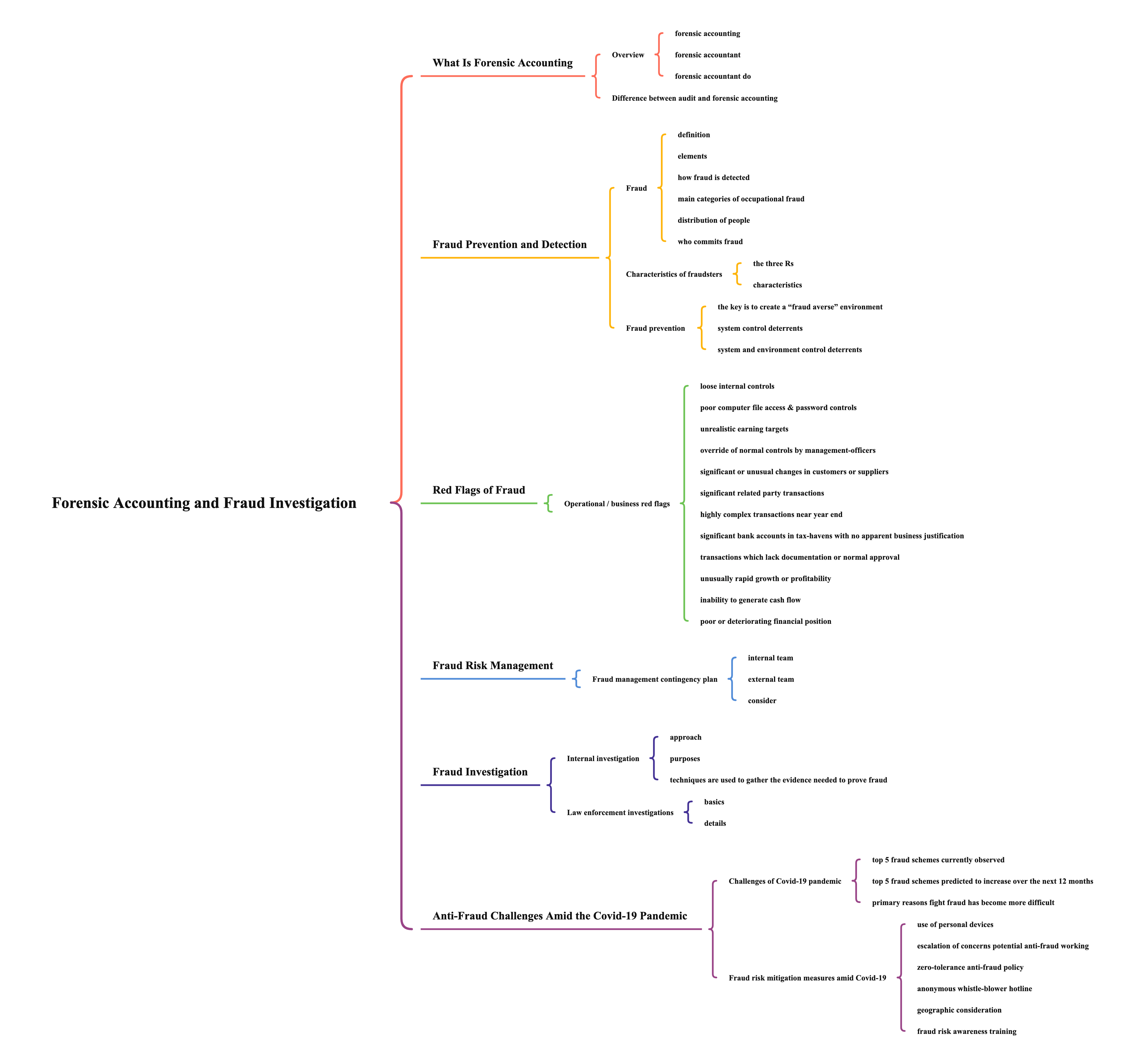

What Is Forensic Accounting

Overview

- forensic accounting

- a discipline that deals with the relationship and application of financial facts as they relate to legal issues in the court of law

- an important tool that assists in investigating crimes such as bribery, fraud, money laundering and other white collar crimes

- forensic accountant

- financial and fraud investigator

- identifier of issues

- gatherer of information

- analyst of documentation

- analyst of people

- expert witness

- forensic accountant do

- fraud prevention and detection

- forensic and fraud investigation

- regulatory compliance and internal control review

- asset tracing and recovery

- anti-money laundering investigation and review

- litigation support

- expert witness reporting and testimony

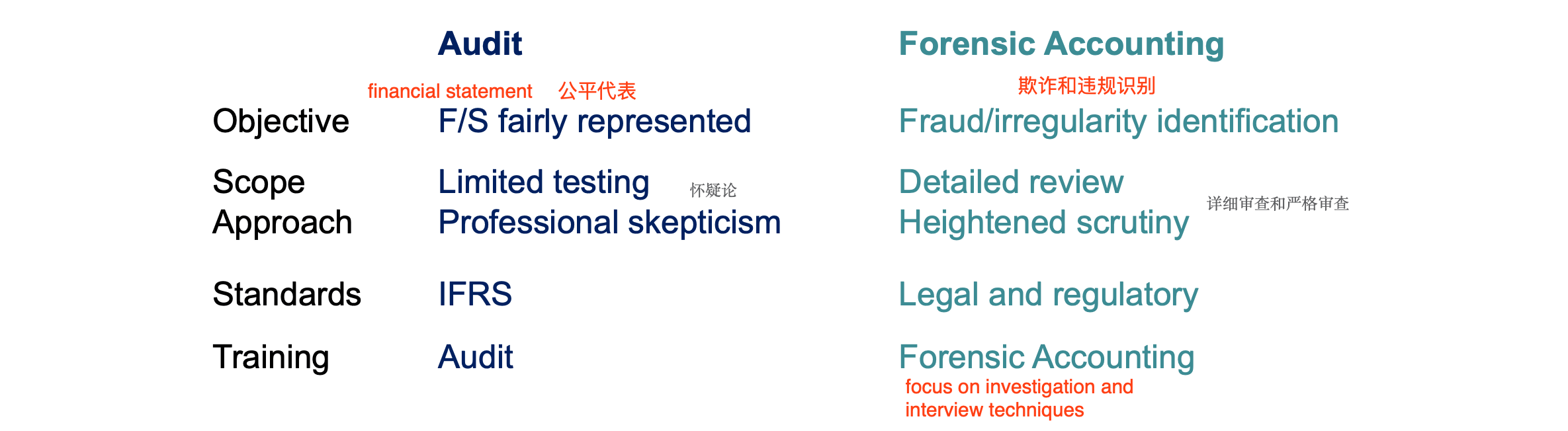

Difference between audit and forensic accounting

Fraud Prevention and Detection

Fraud

- definition

- fraud refers to an intentional act by one or more individuals among management, those charged with governance, employees, or third parties, involving the use of deception to obtain an unjust or illegal advantage

- elements

- opportunity

- motive

- rationalization

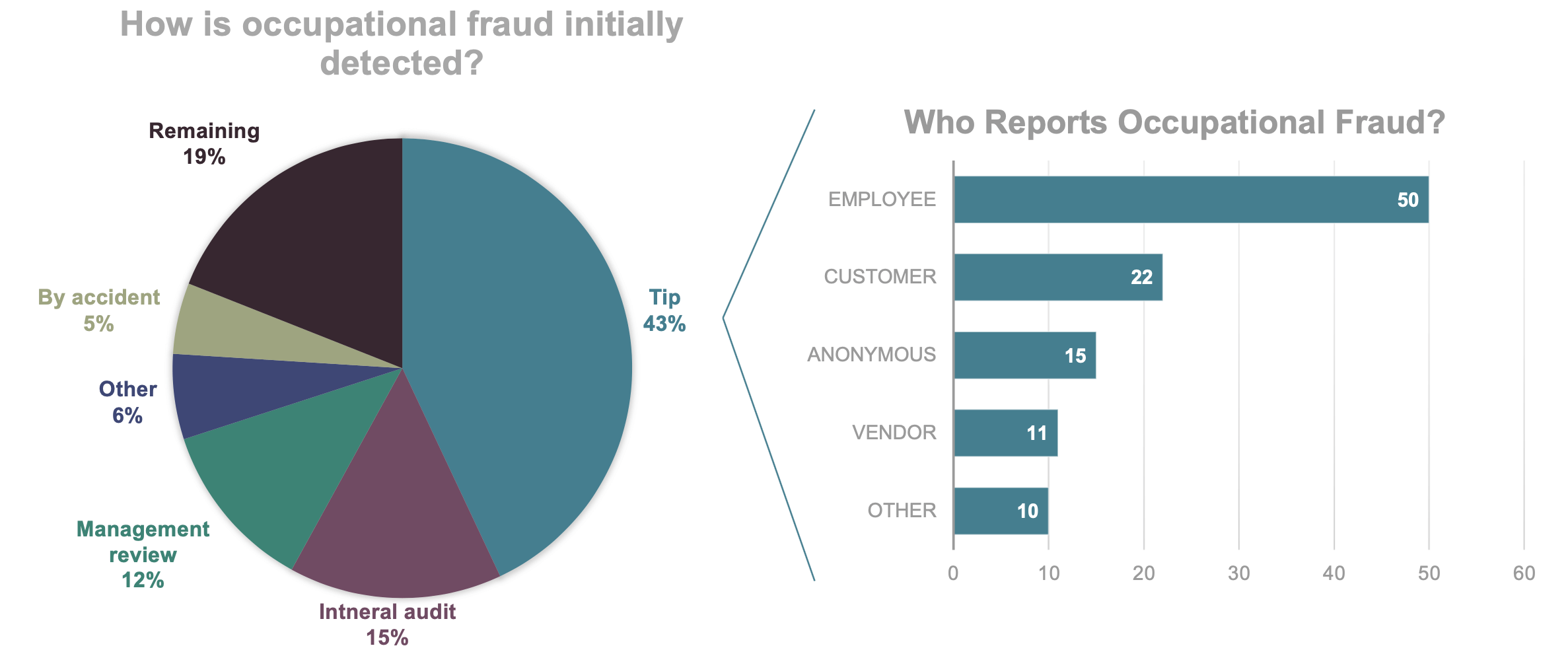

- how fraud is detected

- whistleblowers

- management review

- internal controls

- by accident

- internal audit

- external audit

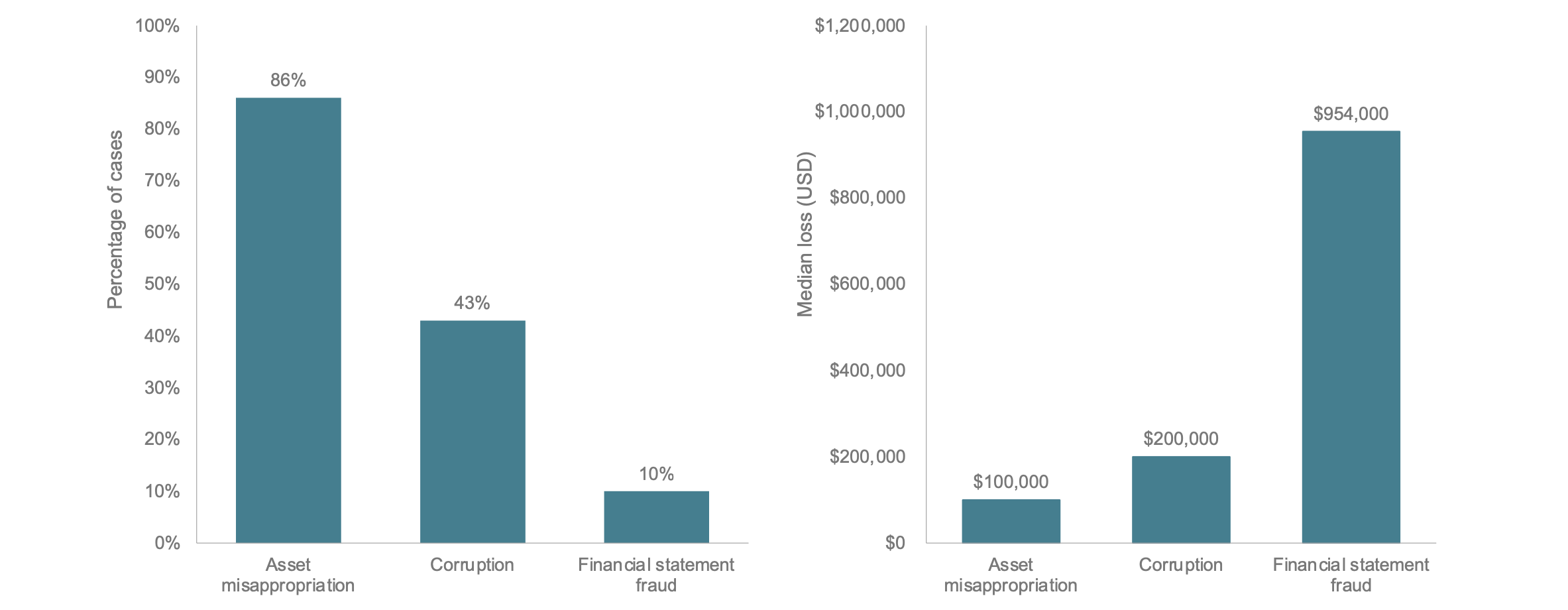

- main categories of occupational fraud

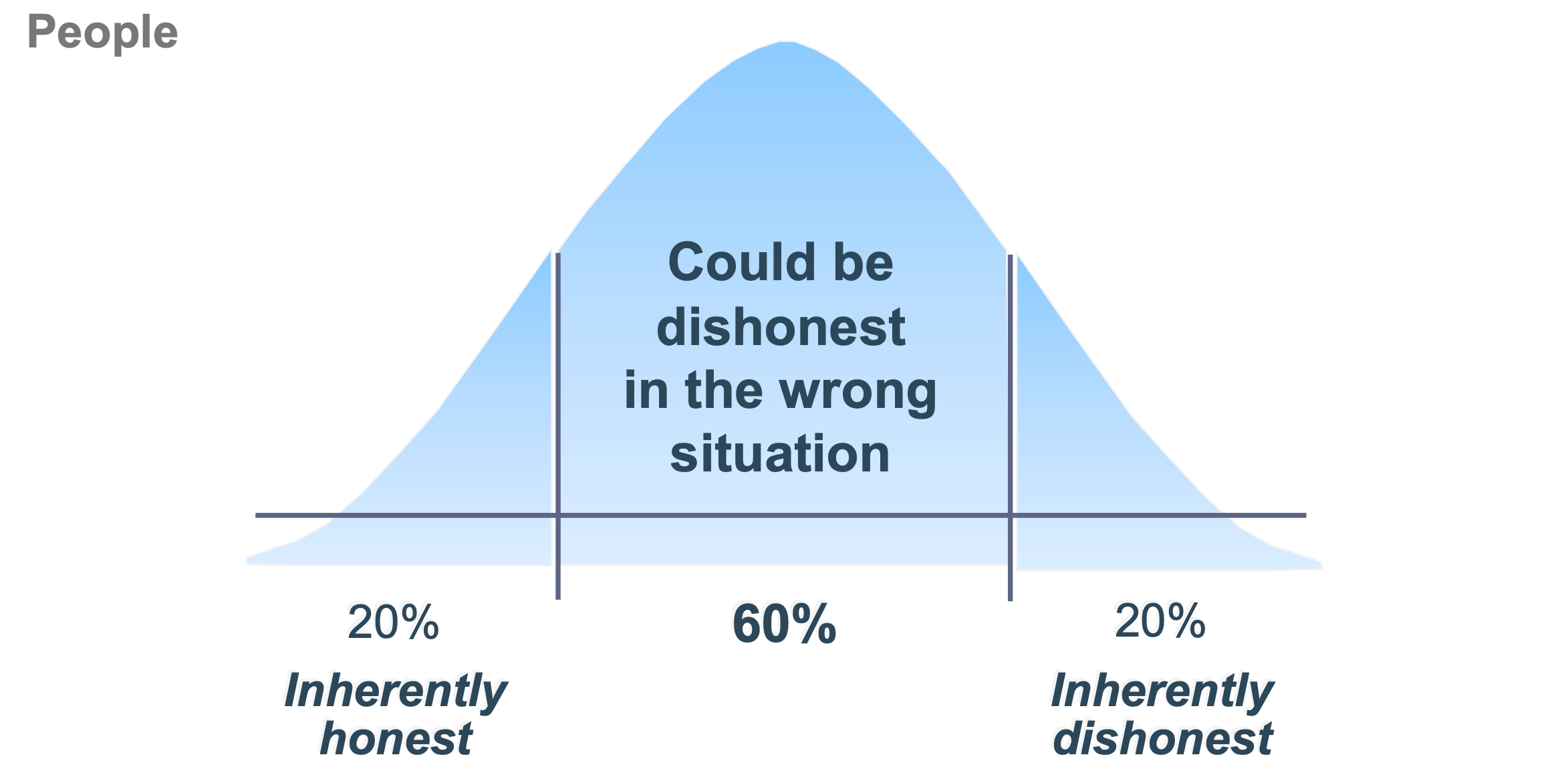

- distribution of people

- who commits fraud

- suppliers

- competitors

- customers

- officers

- managers

- employees

- directors

Characteristics of fraudsters

- the three Rs

- rum

- racecars

- romancers

- characteristics

- greed

- ego or peer group pressure

- drugs/gambling problem

- living beyond one’s means

- being dissatisfied or frustrated with job

- seeing “beating the system” as an intellectual challenge

- demanding exclusive contact with client

- demanding unusual expediency

- having unusually close association with suppliers

Fraud prevention

- the key is to create a “fraud averse” environment

- setting various deterrents

- physical, e.g. lock

- system controls

- environmental

- setting various deterrents

- system control deterrents

- adequate documents and records

- proper procedures for authorization

- supervision and control

- segregation of duties

- mandatory vacation

- new employee vetting

- anonymous complaint hotline/channel

- internal audit

- system and environmental control deterrents

- internal control

- ethical corporate culture

- atmosphere to discuss problem

- anti-fraud policy - consistent approach to incidents

- dismissal

- report to police, regulatory authorities

- recovery

- report to audit committee / board of directors

- code of conduct

- fraud awareness training

Red Flags of Fraud

Operational / business red flags

- loose internal controls

- poor computer file access & password controls

- unrealistic earning targets

- override of normal controls by management-officers

- significant or unusual changes in customers or suppliers

- significant related party transactions

- highly complex transactions near year end

- significant bank accounts in tax-havens with no apparent business justification

- transactions which lack documentation or normal approval

- unusually rapid growth or profitability

- inability to generate cash flow

- poor or deteriorating financial position

Fraud Risk Management

Fraud management contingency plan

- internal team

- HR

- counsel

- external team

- independence and expertise

- consider

- evidence available

- preservation of evidence

- witnesses

- assessing the damage

- freezing orders

- notification to insurer and regulator

- working with police

Fraud Investigation

Internal investigation

- approach

- interview management and relevant staff

- review accounting records and major contracts

- conduct investigation of suspicious transactions

- quantify the loss suffered

- collect evidence for trial

- purposes

- learn the nature and extent of the problem

- avoid violating regulatory requirements

- develop information sufficient to report (if necessary) to regulators

- enable the institution to minimize its liability and

- stop any potential money laundering or other irregularities from fraudulent activities

- identify any internal control issues that facilitates the fraud/fraudulent activities

- put in place proper control measures

- ensure the same problem will not happen again

- techniques are used to gather the evidence needed to prove fraud

- documentary evidence

- obtained from searches of public records and computer databases

- document reviews

- re-computations and analysis of records, contracts, leases, loan agreements, bank records, financial statements, etc.

- testimonial evidence

- obtained from interviews and interrogations

- observational evidence

- obtained from physical inspection of evidence, surveillance

- confirmation with independent third parties, fixed-point observation, behavioral or personality assessments, and lifestyle observations

- data analytics and computer forensic

- other physical evidence

- fingerprint

- handwriting

- document examination

- chemical or photographic analysis

- documentary evidence

Law enforcement investigations

- basics

- law enforcement agencies might request information and documents from financial institutions or listed companies

- the documents and testimony are designed to allow the law enforcement agency to investigate suspicious transactions, develop evidence and, ultimately, put together a case for prosecution

- a search warrant is a grant of permission from a court for a law enforcement agency to search certain designated premises and to seize specific categories of items or documents

- if the law enforcement agency or a prosecutor obtains a court order to freeze an account or to prevent funds from being withdrawn or moved, the institution should obtain a copy of the order and should comply with it

- details

- monitoring the institution’s response to a law enforcement investigation

- when a financial institution receives a subpoena, summons or other government request, you should:

- ensure that all submissions are reviewed by senior management or counsel

- maintain a centralized control over all requests and responses

- when a financial institution receives a subpoena, summons or other government request, you should:

- dealing with regulators

- to cooperate

- to make every effort to stay on good terms

- to learn their views of facts

- media relations

- if the facts are not on the institution’s side, “no comment” may be the best response

- monitoring the institution’s response to a law enforcement investigation

Anti-Fraud Challenges Amid the Covid-19 Pandemic

Challenges of Covid-19 pandemic

- top 5 fraud schemes currently observed

- cyberfraud

- e.g. business email compromise, hacking, ransomware, and malware

- identity theft

- payment fraud

- e.g. credit card fraud and fraudulent mobile payments

- unemployment fraud

- fraud by vendors and sellers

- cyberfraud

- top 5 fraud schemes predicted to increase over the next 12 months

- cyberfraud

- payment fraud

- unemployment fraud

- fraud by vendors and sellers

- health care fraud

- primary reasons fight fraud has become more difficult

- physical restrictions placed on anti-fraud staff (most common challenges center)

- inability to travel

- difficulties in conducting remote interviews

- a lack of access to evidence

- a slight decrease in respondents who are challenged by cancelled or postponed engagements

- increases in difficulties with

- remote interviews

- technology challenges

- physical restrictions placed on anti-fraud staff (most common challenges center)

Fraud risk mitigation measures amid Covid-19

- use of personal devices

- escalation of concerns potential anti-fraud working

- zero-tolerance anti-fraud policy

- anonymous whistle-blower hotline

- geographic consideration

- fraud risk awareness training

fite7410 financial fraud analytics fintech forensic accounting fraud investigation

960 Words

2021-03-26 09:45