5 minutes

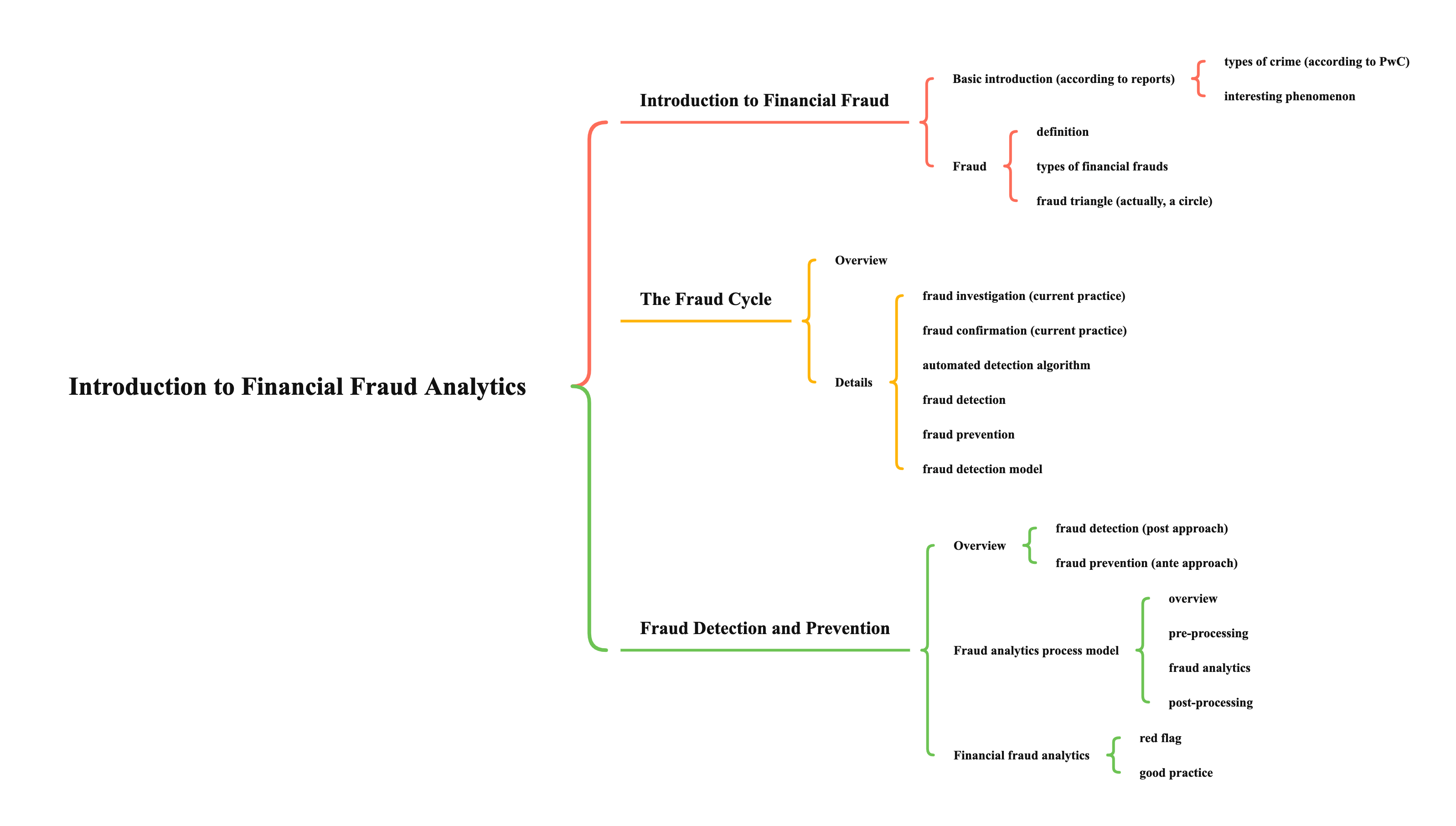

FITE7410 Introduction to Financial Fraud Analytics

Introduction to Financial Fraud

Basic introdution (according to reports)

- types of crime (according to PwC)

- accounting/financial statement fraud

- anti-competition/antitrust law infringement

- bribery and corruption

- customer fraud

- cybercrime

- deceptive business practices

- human resources fraud

- insider/unauthorized trading

- intellectual property (IP) theft

- money laundering and sanctions

- procurement fraud

- interesting phenomenon

- approxiamtely 50% of companies experienced fraud in the past 2 years

- but only 56% of companies conducted investigations into their worst incidents

Fraud

- definition

- no formal definition

- English dictionary definition

- the crime of getting money by deceiving people

- legal dictionary definition

- the intentional use of deceit, a trick or some dishonest means to deprive another of his/her/its money, property or a legal right

- types of financial frauds

- no single definition

- categorization (by FBI)

- bank fraud

- credit card fraud

- application fraud

- obtain new credit cards using false personal information

- spending as much as poosible in a short time

- behavioral fraud

- stole details of credit cards (not physical card), using on a “cardholder not present” basis

- most common type

- application fraud

- mortgage fraud

- money laundering

- make illegally obtained gain and proceeds seemingly legal

- AML (Anti-Money Laundering) compliance is mandatory requirements for running business in the financial sector

- credit card fraud

- corporate fraud

- financial statement fraud

- represent fake financial condition of a company

- deveive or mislead to the users of the financial statements

- e.g. Enron

- securities and commodities fraud

- financial statement fraud

- insurance fraud

- any types of insurance

- automobile insurance fraud (by FBI)

- health care fraud (by FBI)

- from the issuer (seller)

- selling policies from non-existent companies

- failing to submit premiums

- churning policies to create more commissions

- from the buyer

- exaggerated claims

- falsified medical history

- post-dated policies

- faked death

- faked damage

- any types of insurance

- bank fraud

- other types

- identity theft

- replace someone to make transactions or purchases

- stealing lists of customer information

- tax evasion

- underpay taxes

- securities fraud

- a false statement about a company or company’s valued stock

- others make decisions based on that lie

- identity theft

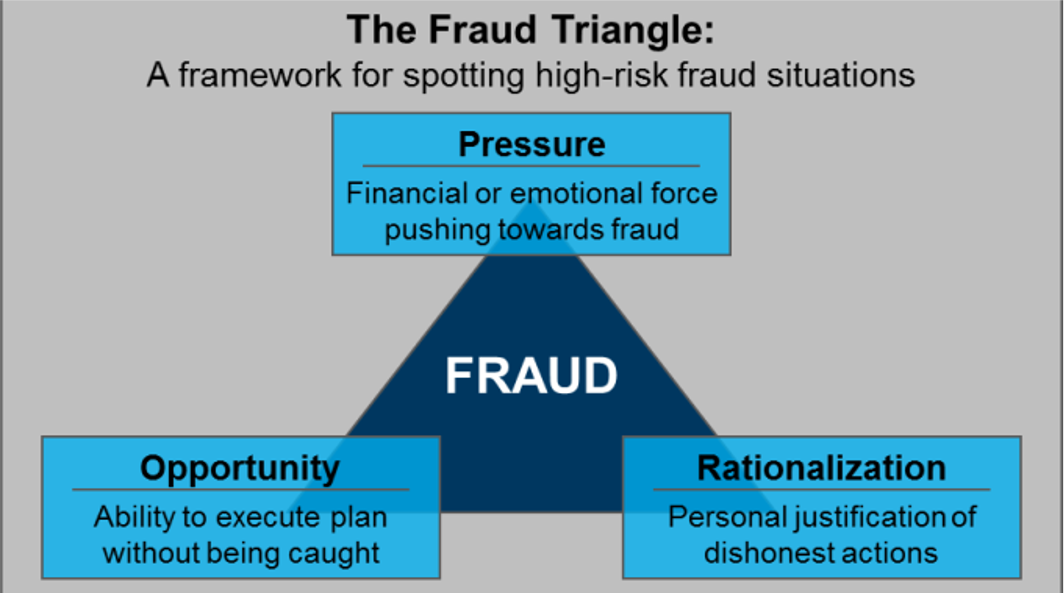

- fraud triangle (actually, a circle)

- pressure

- from financial, social, or any other nature

- it cannot be resolved or relieved in an authorized manner

- opportunity

- opportunity exists to resolve or relieve the experienced pressure in an unauthorized but concealed or hidden manner

- rationalization

- pyschological mechanism, explain why fraudsters do not refrain

- think conduct as acceptable

- pressure

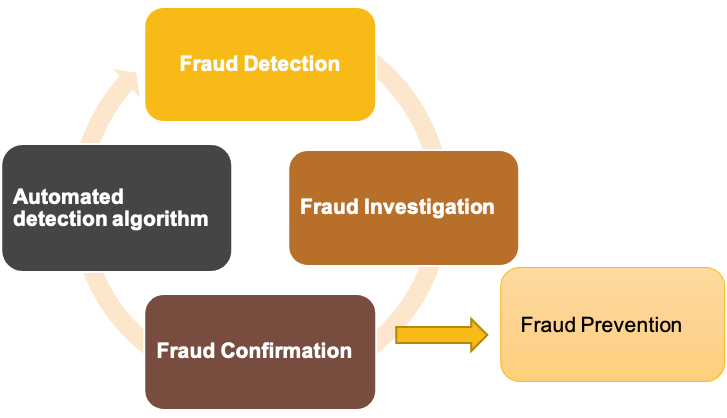

The Fraud Cycle

Overview

Details

- fraud investigation (current practice)

- a human expert investigates suspicious, flagged cases

- fraud confirmation (current practice)

- determine true fraud label

- after this, 2 measures will be taken

- corrective measures

- resolve the fraud and correct the wrongful consequences -> fix

- preventive measures

- preventing future fraud by the same fraudster or others -> prevent

- corrective measures

- automated detection algorithm

- newly detected cases should be addded to the database of historical fraud cases -> optimize the model

- fraud detection

- apply detection model on new, unseen observations

- assign a fraud risk to every observation

- fraud prevention

- prevent fraud in the future

- detect or predict fraud before it happens

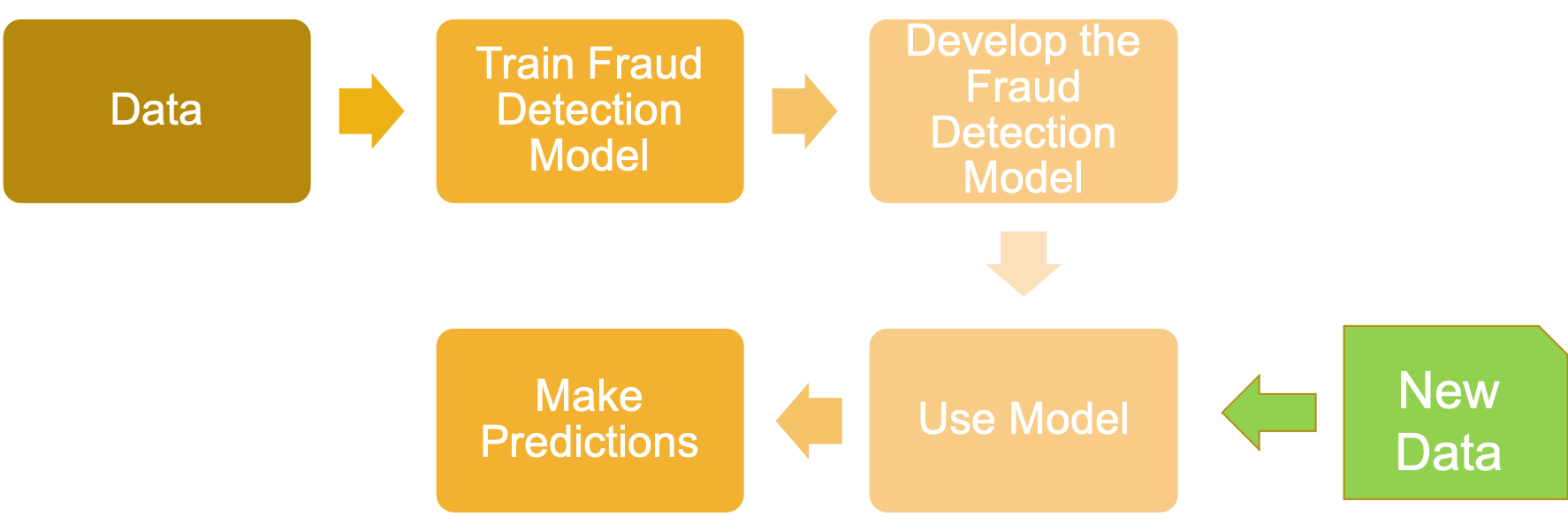

- fraud detection model

- frequency of re-training the model depends on

- volatility of the fraud behaviour

- detection power of the current model

- amount of (similar) confirmed cases already available in the database

- rate at which new cases are being confirmed

- required effort to retrain the model

- frequency of re-training the model depends on

Fraud Detection and Prevention

Overview

- fraud detection (post approach)

- recognize or discover fradulent activities

- traditionally, expert-based approach

- depends on a human’s professional knowledge to build a number of rule-based engines (IF…, THEN…)

- disadvantages

- expensive to build -> manual input

- difficult to maintain -> manually and regularly updated

- slow response time to new fraud cases -> expert needs to study new fraud cases

- prone to human error -> relies heavily on human expert

- reasons for using data driven fraud detection

- precision

- process massive volumes of data

- more efficient than human eyes

- operational efficiency

- process a huge amount of cases in a short time

- cost efficiency

- compared with expert-based system, better cost efficiency and ROI

- precision

- fraud prevention (ante approach)

- avoid or reduce fraud

- complementary to fraud detection, not independent of fraud detection

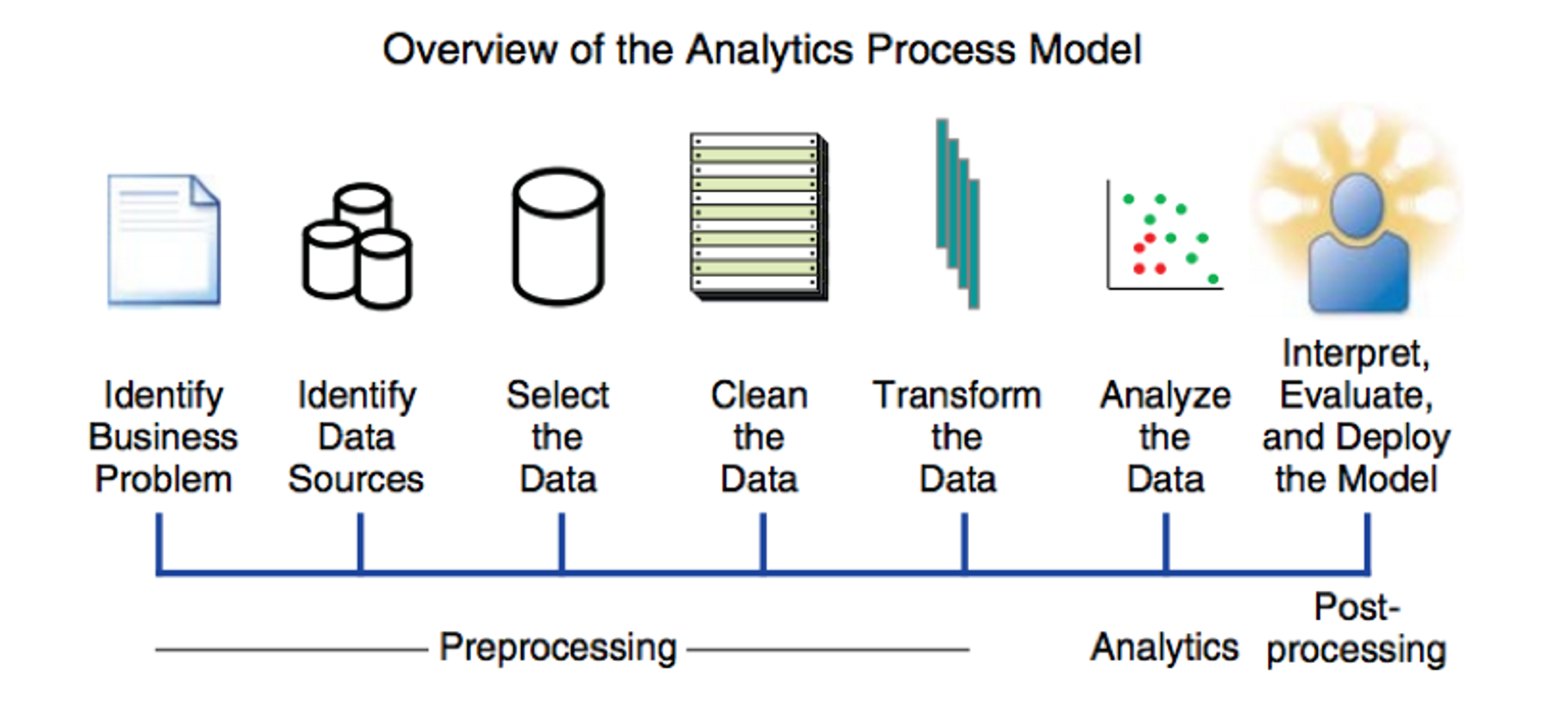

Fraud analytics process model

- overview

- is not a linear process but a cyclic process

- one may go over to the previous steps during the process

- pre-processing

- identify business problem is the most important task in this part

- fraud analytics

- techniques used

- expert-based techniques

- statistical techniques

- AI/data mining/machine learning techniques

- techniques used

- post-processing

- key characteristics of a good fraud analytics model

- statistical accuracy

- accuracy is not the only parameter, e.g. capacity or capability of the model

- statistically significant, i.e. the patterns found is not the consequence of coincidence

- interpretability

- black-box models are acceptable

- operational efficiency

- real-time evaluation

- re-estimate the model when necessary

- economical cost

- tech and human cost of building models

- regulatory compliancy

- should comply with all regulation and legislation, e.g. privacy laws

- statistical accuracy

- key characteristics of a good fraud analytics model

Financial fraud analytics

- red flag

- anomality or variation from predictable patterns of normal behavious

- exist in

- data

- documents

- internal controls

- behaviors

- public records

- digital footprints, etc.

- examples

- tax evasion fraud

- an identical financial statement, copy nonfraudulent companies

- name of an accountant is unique, this accountant may not exist

- credit card fraud

- a small payment followed by a large payment immediately after, test the card is still active

- regular rather small payments, may avoid getting noticed

- tax evasion fraud

- good practice

- plan before acting

- well-defined scope for fraud analytics

- good understanding of fraud data

- distinguish red flags and error in data

- identify false positives and fasle negatives

- e.g. someone uses credit card to purchase frequently in Dec, which may be not fraud due to Christmas

- try not to jump to conclusions without correct and logical linkage to evidence found